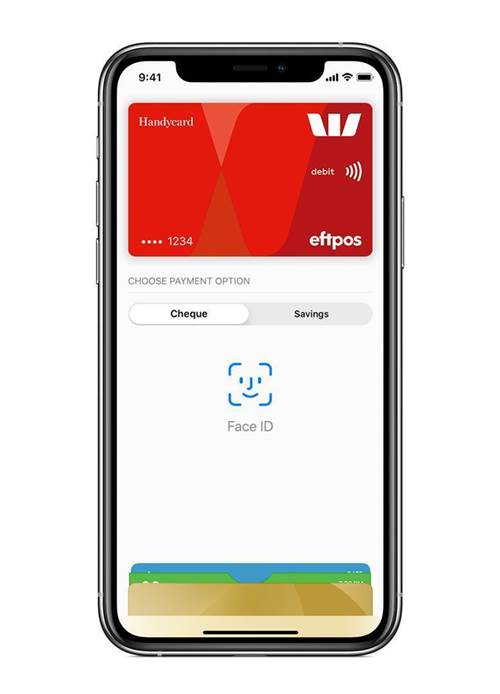

It’s been a long time coming, but Westpac has finally switched on Apple Pay for its customers and will also include eftpos functionality from the outset.

Australia’s oldest bank on Tuesday revealed it had turned the new service on effective immediately, falling in behind its big four rivals the ANZ, the Commonwealth Bank and National Australia Bank.

“This comes at an important time for our customers, who are looking for an alternative to cash,” said the head of Westpac’s consumer bank David Lindberg.

“We have seen a significant increase in customers using digital banking in recent weeks as more Australians stay at home.

"With the introduction of Apple Pay, it will now be even easier for customers to pay for goods and services in stores, via apps or online without the need for a card or wallet."

eftpos built in

The decision to include eftpos functionality from the outset is certain to place pressure on other banks still to activate the ubiquitous local payments scheme on Apple Pay, especially the CBA and NAB which is yet to activate eftpos for the service.

The debit transaction market – as opposed to credit cards – has become significantly more important for banks in the context of the COVID-19 outbreak as institutions batten-down and build up stores to absorb distressed and bad debts certain to flow onto the market, especially around unsecured lending.

Consumers are also avoiding high-priced credit cards, reverting to spending their own money where possible to control their finances.

A real issue banks face is around the branding of debit products, especially the perception that debit scheme products like Mastercard and Visa are somehow linked to credit cards, especially when banks offer both products from both brands.

The issue is especially pertinent to older Australians who are now grappling with online commerce for the first time, especially for transactions they may have previously made in person, like bill payments and grocery shopping where they hit the SAV or CHQ button on a payments terminal.

eftpos CEO Stephen Benton said that it was "great to see that Westpac debit cardholders can now access eftpos CHQ & SAV with Apple Pay."

"It offers customers fast, easy and secure access to their own money, including getting cash out when you shop at participating merchants. Customers can also feel good about selecting eftpos because they may be helping to save small businesses money in fees during these difficult times," Benton said.

The long road

Westpac’s long road to turn on Apple Pay for its main brand has been a sticking point ever since the CBA effectively collapsed an informal boycott by three of Australia’s big four that included Westpac and NAB.

Unlike its peers, ANZ had from the outset activated Apple Pay, adding eftpos shortly after, arguing it was what its customers wanted.

Other institutions had held out from activation, hoping to cut a better deal on fees flowing to from Apple, which payments industry insiders say essentially strips out interchange fee income to institutions.

When the CBA moved to activate Apple Pay in December 2018, it was one of the first decisive moves then incoming chief executive Matt Comyn made to appease customers and restore trust in the bank after taking a reputational battering from the Royal Commission and AUSTRAC.

The move also caught CBA’s rivals off guard, with millions downloading the Apple Pay app almost as soon as it was offered by Australia’s largest bank.

Westpac’s activation will also take a little heat off it’s highly regarded chief information officer Craig Bright, who arrived just as the bank came into the crosshairs of AUTRAC and lost its chief executive and chairman.

Rather than explaining why Apple Pay is taking so long, the pressure will now fall on some of the other banks as to why they are still not enabling local debit payments providers and favouring multinational brands in a time of economic crisis.

Apple Pay for Westpac offers tokenisation out of the box, a major factor in keeping down the nasty growth in online credit card and scheme debit card fraud.

Token effort

Fraudsters and card sharps might also find life that little bit harder as Westpac's transactions move from plastic to glass.

Westpac says that when customers use a credit or debit card with Apple Pay, “the actual card numbers are not stored on the device, nor on Apple servers.”

“Instead, a unique Device Account Number is assigned, encrypted and securely stored in the Secure Element on your device.

"Each transaction is authorised with a onetime unique dynamic security code,” Westpac said in a statement reciting Apple Pay's boilerplate.

_(36).jpg&h=140&w=231&c=1&s=0)

_(37).jpg&h=140&w=231&c=1&s=0)

_(33).jpg&h=140&w=231&c=1&s=0)

Cyber Resilience Summit

Cyber Resilience Summit

iTnews Executive Retreat - Security Leaders Edition

iTnews Executive Retreat - Security Leaders Edition

Huntress + Eftsure Virtual Event -Fighting A New Frontier of Cyber-Fraud: How Leaders Can Work Together

Huntress + Eftsure Virtual Event -Fighting A New Frontier of Cyber-Fraud: How Leaders Can Work Together

iTnews Cloud Covered Breakfast Summit

iTnews Cloud Covered Breakfast Summit

Melbourne Cloud & Datacenter Convention 2026

Melbourne Cloud & Datacenter Convention 2026

_(1).jpg&h=140&w=231&c=1&s=0)