OnePath, the life insurer formerly owned by ANZ Wealth and now Zurich, has been revealed as an early adopter of artificial intelligence, using it to visualise trends in 10 years of claims data.

Details of the project - and system - emerged during a presentation by Wipro-owned Appirio at Salesforce’s recent Dreamforce 19 conference in San Francisco.

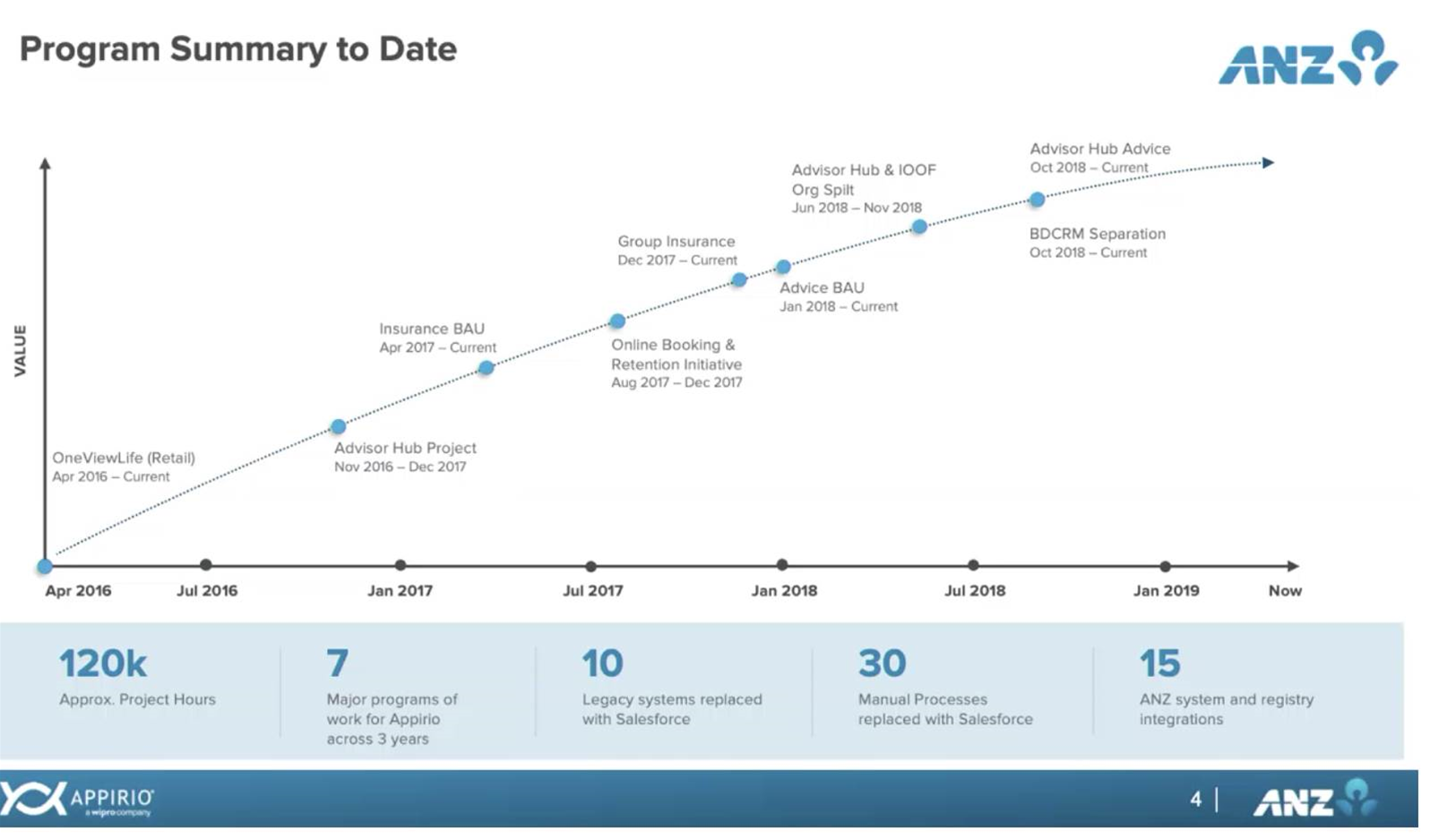

Appirio said it had worked on a transformation of Salesforce within the now-splintered ANZ Wealth business since 2016.

In June last year, ANZ Wealth sold its life and consumer credit insurance business - OnePath Life - to Zurich Financial Services Australia.

It went on to divest its OnePath Pensions & Investments business to IOOF a few months later.

Appirio’s sales director for Asia Pacific, Andy Pattinson, told the conference that Appirio was now engaged across the three businesses.

“One thing that happened with ANZ, they divested a couple of businesses out, and that's now spread into three organisations - Zurich, IOOF and ANZ - and we're seeing the way we're working spidering,” Pattinson said.

Appirio started working with ANZ Wealth back in April 2016 and has since been part of seven “major programs of work” in the past three years.

In that time, it helped ANZ Wealth replace 10 legacy systems and 30 manual processes with new ways of working enabled by Salesforce, Appirio noted in a slide deck.

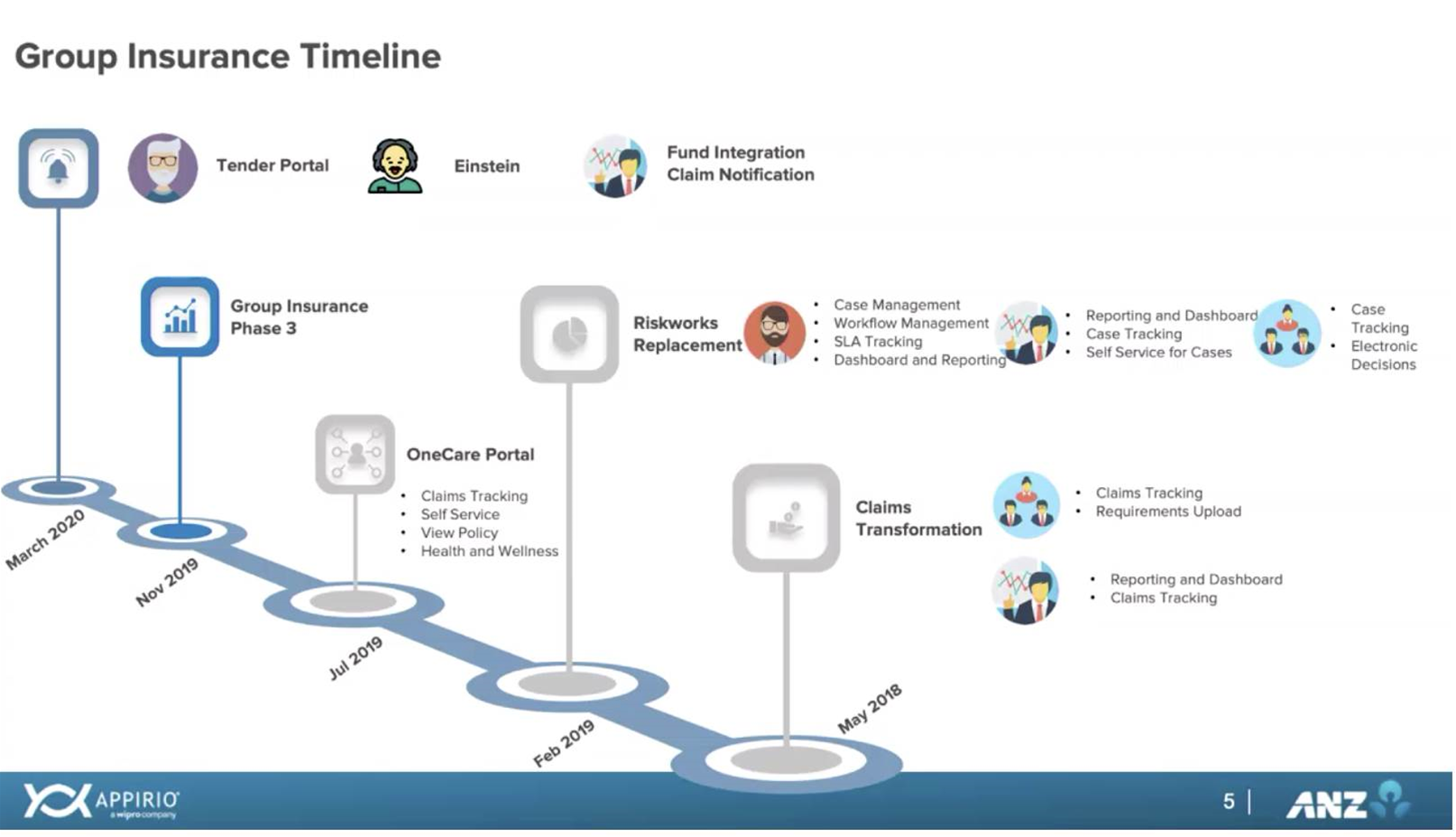

It continues to work with ANZ directly transforming processes and systems around the bank’s group insurance product, with that work extending through to at least March this year, according to another slide.

However, when it was first engaged in 2016, Appirio noted ANZ wanted to use Salesforce to help it understand its claims data and keep track of performance.

Through that work, the OnePath life insurance business became “one of the first” Australian companies to adopt Salesforce’s Einstein artificial intelligence technology, Appirio’s Asia Pacific general manager Gaurav Pruthi said.

Though ANZ Wealth has been name-dropped as a Salesforce customer in the past, details of its AI use case have not previously been made public.

“What they've done is they've put their whole claims process on Einstein so all the data they get from all their claims across Australia goes into Salesforce, which is presented back to the board in Einstein,” he said.

“It not only allows the board but also allows all the [insurance] agents to see how they're tracking.”

Pruthi said that 10 years of claims data had been brought into the platform.

“What it allowed them to do was look at, for example, car accidents [by] age group and where and how [they occur],” he said.

“When they actually go to market now, and them being a life insurer, when they go compete for business, this is what they show customers to say, ‘We know your business because we know the data and this is how we're going to help you’.”

Pattinson said the AI capability continued to win OnePath business.

“Interestingly, this capability was one of the critical success factors for them winning a recent large deal in Australia,” he said.

“There was an incumbent organisation that was bidding against them. They showed this to the potential customer and it really tipped the client over the deal and has won them a really significant new piece of business.

“It's completely transformed the way they go to market to sell to their corporate customers.”

OnePath is far from alone in using AI to understand claims data.

Suncorp uses other AI suites to identify claims that are taking too long to resolve, determine liability in motor vehicle accident claims, and to help customers work out what they can claim under their policies.

Health insurer nib has also run several AI test cases.

Ry Crozier attended Salesforce's Dreamforce 19 conference in San Francisco as a guest of Salesforce.

.png&h=140&w=231&c=1&s=0)

_(28).jpg&h=140&w=231&c=1&s=0)

iTnews Executive Retreat - Security Leaders Edition

iTnews Executive Retreat - Security Leaders Edition

iTnews Benchmark Awards 2026

iTnews Benchmark Awards 2026

iTnews Cloud Covered Breakfast Summit

iTnews Cloud Covered Breakfast Summit

The 2026 iAwards

The 2026 iAwards

_(1).jpg&h=140&w=231&c=1&s=0)