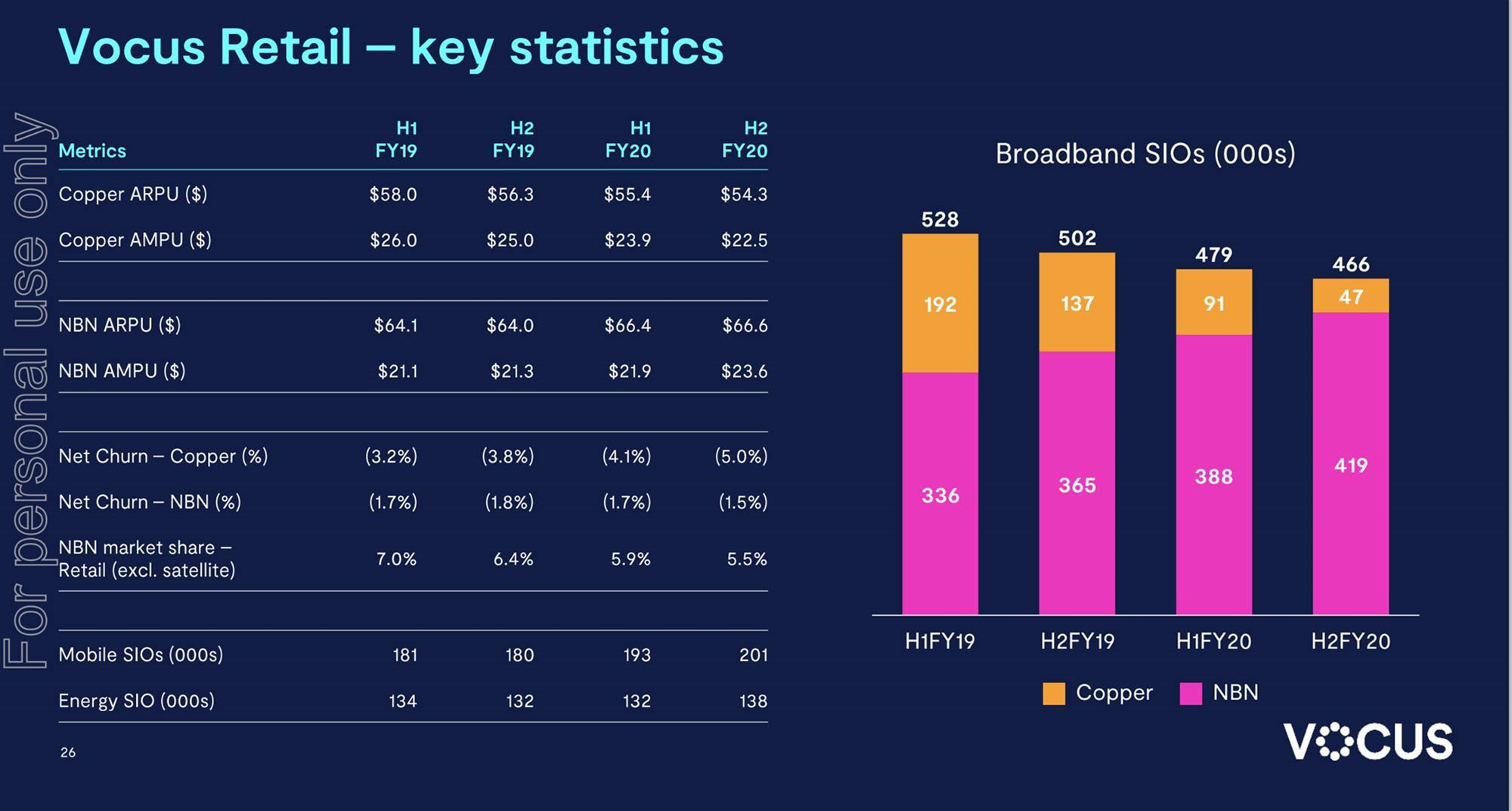

Vocus has reported an $2.30 increase in the average margin per NBN user across FY20, appearing to buck downward pressure experienced elsewhere in the sector through a combination of NBN price reductions and cost-cutting on its own end.

The telco said its NBN average margin per user (AMPU) increased from $21.30 at the end of FY19 to $23.60 at the end of FY20. Average revenue per user (ARPU) was also up $2.60 for the year.

FY20 marked the first time that Vocus’ NBN margins came in above its copper margins, at least in the second half.

Vocus Group managing director and CEO Kevin Russell said the second half also marked the first time the company’s Dodo brand had experienced net subscriber growth in three years.

“Our vision for Vocus is to be the challenger our customers deserve and our people are proud of every day,” Russell said.

“We've absolutely seen the best of Vocus in pursuing this vision over these past six months.

“In a period of significant change and cost reduction, the operational performance of every single business unit has strengthened.”

Group CFO Nitesh Naidoo said the company had made ”significant progress” in stabilising the performance of its retail division.

However, the small-to-medium business (SMB) segment - represented mostly by the Commander brand - “faces increasingly challenging market conditions”, Naidoo said, indicating it would act as a drag on results.

“The small and medium segment outlook in the current market conditions remain weak and is expected to be challenging in the near term,” he said.

“As a result of this outlook, Vocus has taken a decision to limit investment [in SMB] for a period, and manage the economics very carefully.”

Naidoo said Vocus had spent FY20 carefully reducing overhead costs, especially in retail.

“Retail overheads have reduced 24 percent since FY18,” he said.

“The retail team has demonstrated the challenger mindset in cost management and turning around the business to establish a platform for growth.

“There will be continued cost focus within the organisation, which is required by a market challenger.

“However, the major cost out has been delivered and not the same quantum is expected going forward.

In the enterprise space, Vocus had also turned around its relationship with NBN Co, mostly after the latter made key concessions and listened to the resellers of those services following a combative back half of 2019.

“In six months, we've gone from battling with NBN Co to being their number one reseller of Enterprise Ethernet,” Russell said.

“As far as NBN Co goes, we've done a really good job of working out where and how we work with them,” CEO of enterprise and government Andrew Wildblood added.

“On some of the wins we've had in the last few months, including a number of wins over the COVID period, it's been the best-of-breed of our fibre network and NBN access.

“I think we've found a happy medium where we can make good returns and we can demonstrate that there's value in owning the asset and combining with NBN Co.”

On retail, Wildblood said the NBN market had evolved to a point where incumbent players had “retreated to … retain their customer base rather than being aggressive on acquiring new customers.”

“That's good and bad for us in terms of it stabilises our revenues, and certainly we've really done a cracking job this year of controlling churn and price erosion, therefore all of our net sales are dropping to revenue, which is really good news,” he said.

Wildblood said Vocus had also addressed retail pricing ahead of others, such as Telstra, giving it a head start.

He said rivals’ NBN pricing contained significant caveats, and these would help ensure Vocus’ brands could compete on a standalone NBN pricing basis.

“We do see them being a little bit more aggressive now on retaining [customers] and therefore it just tightens up where we play,” he said.

“Certainly the work that I've done in the last 12 months, and structuring my organisation for this year, plays much more to being very, very clear about where we can win and not waste our time where we can't win.”

NBN profitability has been a hot topic of debate once more since Telstra CEO Andy Penn labelled it as "negligible at best" at Telstra's FY20 results last week.

.png&h=140&w=231&c=1&s=0)

.png&w=120&c=1&s=0) Tech in Gov 2025

Tech in Gov 2025

Forrester's Technology & Innovation Summit APAC 2025

Forrester's Technology & Innovation Summit APAC 2025

.png&w=120&c=1&s=0) Security Exhibition & Conference 2025

Security Exhibition & Conference 2025

Integrate Expo 2025

Integrate Expo 2025

Digital As Usual Cybersecurity Roadshow: Brisbane edition

Digital As Usual Cybersecurity Roadshow: Brisbane edition

.jpg&h=140&w=231&c=1&s=0)