UBank is looking to expand the reach of its first chatbot and give it greater capabilities to 'read' and respond to users' moods, following its introduction in May.

Known as Robochat, it is powered by a mix of IBM Watson and UBank's existing chat engine, LiveEngage from Liveperson, and is designed to answer questions posed by prospective home loan applicants.

The bank's head of digital and technology, Jeremy Hubbard, told a Watson summit in Sydney that his team trained Robochat by throwing thousands of customer enquiries at Watson and segmenting these into topic areas, such as interest rates, product features and eligibility.

They categorised enquiries into 40 topic areas, which had thousands of associated questions.

"We paired this work with a conversation flow expert who helped us construct natural flowing conversation," he said.

"This might sound trivial but there is a real art to a natural conversation that flows well."

Throughout a six-week process involving a 12-person team from UBank and IBM, they trained the AI on three keys areas: product details; risk and compliance; and "chit chat" – off-topic questions, which the bot is frequently asked.

"It was good we were prepared for the fun as well as the serious," Hubbard said.

Robochat was first trialled by an internal team. It was then rolled out to friends and family before the first "nerve-wracking" one-week live public pilot.

"Robochat had a tough first day in the office," Hubbard said.

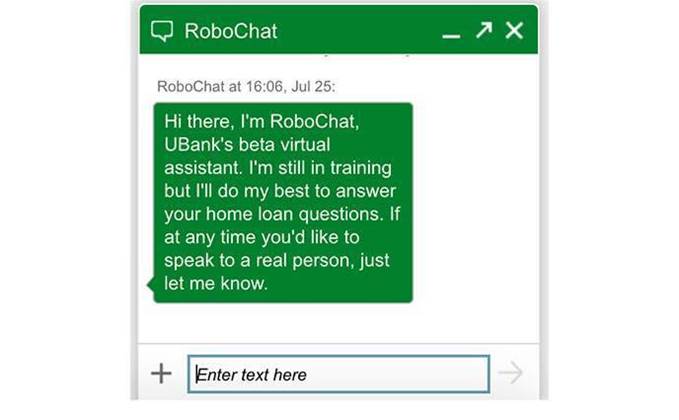

Robochat, which is baked into the UBank website, introduces itself as a chatbot and offers customers the chance to opt out. If it can't answer two questions, Robochat will offer to hand over to a human.

With the basic Robochat application working, UBank is now starting to look at how it can grow the sophistication of the use case.

The next step would be for Robochat "to complete the [home loan] application on behalf of the customer, which would include text to speech and speech to text."

Hubbard also sees further opportunities for Robochat.

Some may come from plugging it into different frontends, such as Facebook Messenger, Google Home and Amazon Alexa.

Hubbard's team will also investigate the IBM Watson Tone Analyser service to understand the customer's mood and adjust answers accordingly, for example by transferring a frustrated customer to a human being.

They are also looking at how to handle context. For instance, a customer may refer back to comments made earlier in the conversation, and the bot needs to be able to recognise that interaction and take it into account.

Hubbard also revealed that UBank had two potential artificial intelligence applications beyond the current use case for home loan applications.

These additional uses were shortlisted in a hackathon process, though Hubbard did not reveal their nature.

_(22).jpg&h=140&w=231&c=1&s=0)

_(23).jpg&h=140&w=231&c=1&s=0)

.png&h=140&w=231&c=1&s=0)

_(26).jpg&w=100&c=1&s=0)

iTnews Executive Retreat - Security Leaders Edition

iTnews Executive Retreat - Security Leaders Edition

_(1).jpg&h=140&w=231&c=1&s=0)