Telstra has emerged from the 2018 financial reporting season with an even higher concentration of NBN power as its rivals struggle to break even on customer migrations.

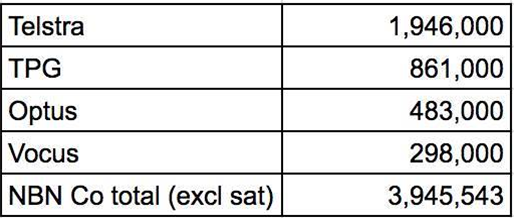

The incumbent telco’s strong NBN gains mean that 90 percent of all active NBN fixed services (that is, excluding satellite) sit with just four companies.

It is the first time that the concentrated power of NBN Co’s biggest four RSPs - Telstra, TPG, Optus and Vocus - has exceeded 90 percent, and means there is less market share left on the table for newcomers than there was even six months ago.

It also means the big keep getting bigger: just two years ago, Telstra, Optus and TPG had between 81.3 and 83 percent of all active NBN connections (Vocus' share at the time was too small to be broken out in regulatory numbers, but would have taken the total market share to 87.45 percent).

The four RSPs maintained that 87.5-odd percent stranglehold in FY17 and are now at 90.9 percent after FY18.

NBN activations in FY18, compiled by iTnews from financial reports. Four companies (with many brands under them) control 3,588,000 active services.

When ADSL losses exceed NBN gains

Both TPG and Vocus - sizable players in the NBN world - lost more residential ADSL customers than they gained NBN customers during the most recent financial year.

Vocus lost 147,000 “copper broadband and bundles” customers and signed up 120,000 NBN users, making for a net decline in consumer fixed-line services of 27,000 users.

TPG - which reported its numbers yesterday - lost 319,000 ADSL customers and signed up 300,000 NBN users as well as 13,000 new users to its own fibre-to-the-basement (FTTB) product. Overall, its topline fixed line number fell by 5000 users.

Contrast that to the fortunes of Telstra and Optus in FY18.

Optus reported a net addition to its residential fixed line base of 75,000 users. It signed on 204,000 NBN services, offsetting the 129,000 or so customers that left its copper, HFC or ‘other’ residential offerings.

Telstra’s numbers are a bit harder to track, since the telco doesn’t report them in the same format as other telcos.

However, the company’s results appeared to show an addition of “88,000 net subscribers” to its retail fixed line business during FY18.

Migrate and still lose margin

The results highlight the ongoing challenge for retail service providers to keep their existing customer bases intact through the migration to the NBN.

It also puts a spotlight on the challenging economics that providers face once they get customers into the NBN ecosystem.

Not breaking even on the number of ADSL customers that leave compared to NBN sign-ups means downwards pressure on margins and therefore revenue.

Put simply, NBN services typically bring in a higher average revenue per user (ARPU) but a much lower average margin per user (AMPU) than an ADSL service.

Vocus continues to be the only telco in that regard to consistently publish data on what this looks like.

On copper broadband and bundles, Vocus saw an average margin of $24.49 from the $58.85 that customers paid on average for their services - meaning about 42 percent of the price is margin, on average.

On NBN, Vocus saw an average margin of $20.84 out of the $63.69 paid by users for internet services, meaning about 33 percent of the price is margin.

If that situation is repeated across all RSPs, they will need to sign on a greater number of NBN users than they had ADSL users just to maintain their previous levels of profitability. It’s likely others are seeing similar challenges; Optus blamed “price erosion” in part for its residential fixed line woes.

Where ADSL losses outstripped NBN sign-ups in FY18, it is clear that this could be an ongoing cause for concern.

A word on the HFC freeze

What isn’t entirely clear from the FY18 results is how much NBN Co’s HFC sales freeze impacted the NBN sign-up numbers, particularly for those that saw net losses in overall fixed line base.

The sales freeze impacted about 1.38 million premises that otherwise would have been released for sale.

Assuming NBN Co is able to get those connections serviceable - it is slowly releasing them back into the market, FY19 could be a boon year for NBN sign-ups and undo some of the pain of FY18.

Correction, 8.54am: Optus numbers were amended to bring them in line with FY18 reporting period of other telcos. The telco still recorded a similar gain in net fixed line users.

_(23).jpg&h=140&w=231&c=1&s=0)

_(28).jpg&h=140&w=231&c=1&s=0)

iTnews Benchmark Awards 2026

iTnews Benchmark Awards 2026

iTnews Executive Retreat - Security Leaders Edition

iTnews Executive Retreat - Security Leaders Edition

iTnews Cloud Covered Breakfast Summit

iTnews Cloud Covered Breakfast Summit

The 2026 iAwards

The 2026 iAwards

_(1).jpg&h=140&w=231&c=1&s=0)