Dry July has only just ended, but the big four banks – through their jointly-owned B2B messaging service LIXI - have proposed a new way to demonise alcohol, thanks in part to the Banking Royal Commission.

LIXI exists to help the residential mortgage industry pass messages between participants, and makes that possible by developing data message transaction standards. Those standards mean market participants should, in theory, all encode their records the same way, which makes it easier to move mortgages between institutions and conduct other transactions.

As assessing mortgagees’ ability to repay a loan is a critical matter, LIXI offers a standard way to record living expenses.

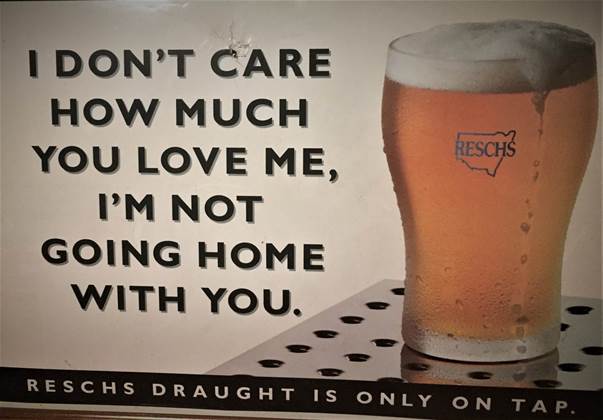

Which brings us to the booze: a current consultation on revised living expenses categories recommends that alcohol be poured out of the category covering groceries and added to the “Recreation and entertainment” basket.

There’s some logic to the change as the recreation category already includes coffee, so it’s not as if beer and wine are the sole beverages decreed to be fun, not food. Other vices, such as tobacco and gambling, are also listed as entertainments.

iTnews has often been told that red wine has health benefits, so suggests alcohol could perhaps be slipped into the “Medical and health” category instead, as it covers pharmaceuticals.

Doing so would not be the strangest thing in the LIXI standard.

Streaming media, for example, is included in a category titled “Telephone, internet, pay TV and media streaming subscriptions”. But “TV, video, games, and audio content, books, newspapers [and] magazines”, whether printed or digital, are classed as entertainment.

Booze-as-medicine would surely not be out of step? In credit card merchant category codes its sometimes treated as a religious product, at least if you're a chaplain needing to top-up the transubstantative Blood of Christ,

LIXI also proposes three new categories, namely:

- Pet Care;

- Sickness and personal accident insurance, life insurance;

- Health Insurance.

The root of the changes is the Banking Royal Commission, which in its interim report questioned whether banks were using the right measures of household expenditure when assessing loan applications. LIXI felt its standard was not aligned with common ways of measuring household spend, hence its decision to change the way lenders consider wine and other changes.

LIXI members are free to comment on the proposed changes.

_(20).jpg&h=140&w=231&c=1&s=0)

iTnews Executive Retreat - Security Leaders Edition

iTnews Executive Retreat - Security Leaders Edition

iTnews Benchmark Awards 2026

iTnews Benchmark Awards 2026

iTnews Cloud Covered Breakfast Summit

iTnews Cloud Covered Breakfast Summit

The 2026 iAwards

The 2026 iAwards

_(1).jpg&h=140&w=231&c=1&s=0)