NBN Co’s slow restart of HFC sales from late April saw less than 1200 users able to sign up and get an active connection by the end of June.

The number - which is drawn from the latest ACCC wholesale market indicators report [pdf] - shows the extent of pain that is likely to be disclosed this reporting season as a result of the HFC sales freeze.

So far, Optus has disclosed a one percent decline in operating revenue in its mass market fixed line business, which it attributed to “the temporary suspension of the NBN HFC connections.”

Telstra is due to report later this week, though has previously forecast a $700 million hit to its income for the 2018 financial year.

Vocus reports later this month while TPG’s HFC impact numbers won’t be known until mid-September.

NBN Co lifted the sales freeze in late April. It said at the time around 39,000 premises would be released for sale by the end of June, and iTnews understands that number was reached.

Of the 39,000 released for sale, however, retail service providers were able to sell and get activated just 1192 new HFC connections before the end of June, according to the ACCC data.

That will cause some financial pain as the HFC network had been a growth engine prior to the sales freeze, in part because it can support the higher residential speed tiers on offer.

However, it does not show how well RSPs have rebuilt their HFC sales pipelines in the wake of HFC's resumption.

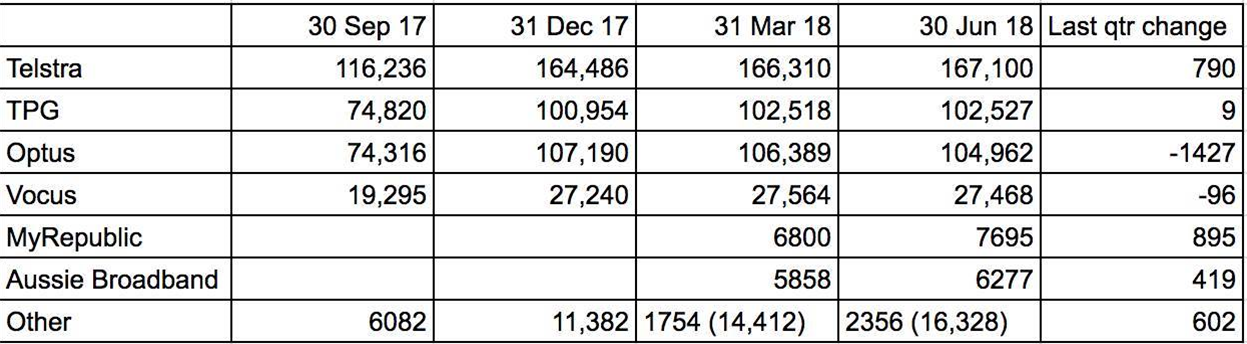

[HFC numbers drawn from past year of ACCC reports, encompassing the sales freeze and resumption. Bracketed 'other' numbers include RSPs that are now broken out]

Of the RSPs named, MyRepublic, Telstra and Aussie Broadband fared best in the HFC restart, in terms of getting new HFC connections activated.

TPG was completely flat - adding just nine HFC activations in the restart.

Perhaps surprisingly, the number of HFC services operated by Optus and Vocus actually fell after sales of the access technology resumed.

An Optus spokesperson was contacted for context on its fall in NBN HFC subscriber numbers, but did not respond by the time of publication.

What’s still unclear in all of this is how the sales freeze hurt NBN Co.

Since announcing the freeze in late November last year, the company has repeatedly declined to discuss the economic impacts of delayed sales and of bringing forward remediation work.

The freeze is known to have impacted about 1.38 million premises. This is partly because NBN Co did not stop building out its HFC network while it worked out how to remediate the frozen portions.

While some of the secrets could be disclosed as early as this week, when NBN Co reports its full-year results, a more likely scenario is that the detail is left until the company’s next corporate plan, due at the end of the month.

_(36).jpg&h=140&w=231&c=1&s=0)

_(33).jpg&h=140&w=231&c=1&s=0)

Cyber Resilience Summit

Cyber Resilience Summit

iTnews Executive Retreat - Security Leaders Edition

iTnews Executive Retreat - Security Leaders Edition

Huntress + Eftsure Virtual Event -Fighting A New Frontier of Cyber-Fraud: How Leaders Can Work Together

Huntress + Eftsure Virtual Event -Fighting A New Frontier of Cyber-Fraud: How Leaders Can Work Together

iTnews Cloud Covered Breakfast Summit

iTnews Cloud Covered Breakfast Summit

Melbourne Cloud & Datacenter Convention 2026

Melbourne Cloud & Datacenter Convention 2026

_(1).jpg&h=140&w=231&c=1&s=0)