NAB has finished “the most scary part” of a complex re-platforming of Podium, a technology platform relied on by some 2800 mortgage brokers, shifting their data across over 13 fortnights.

Podium is what NAB calls the customer relationship management (CRM) system it provides to mortgage brokers via three aggregators - PLAN, Choice and FAST.

It enables brokers to select and compare loan products between lenders, file loan applications, generate compliance paperwork and associated tasks.

The system has always been underpinned by Salesforce (together with some bundled in-house built functions) but was “reimagined” in a large-scale project to simplify it, improve the broker experience, and avoid hitting some fast-approaching technical limitations.

When the bank last spoke about Podium Reimagined at the Salesforce World Tour event in Sydney in March 2019, it had replatformed Podium to run primarily using Salesforce’s Communities.

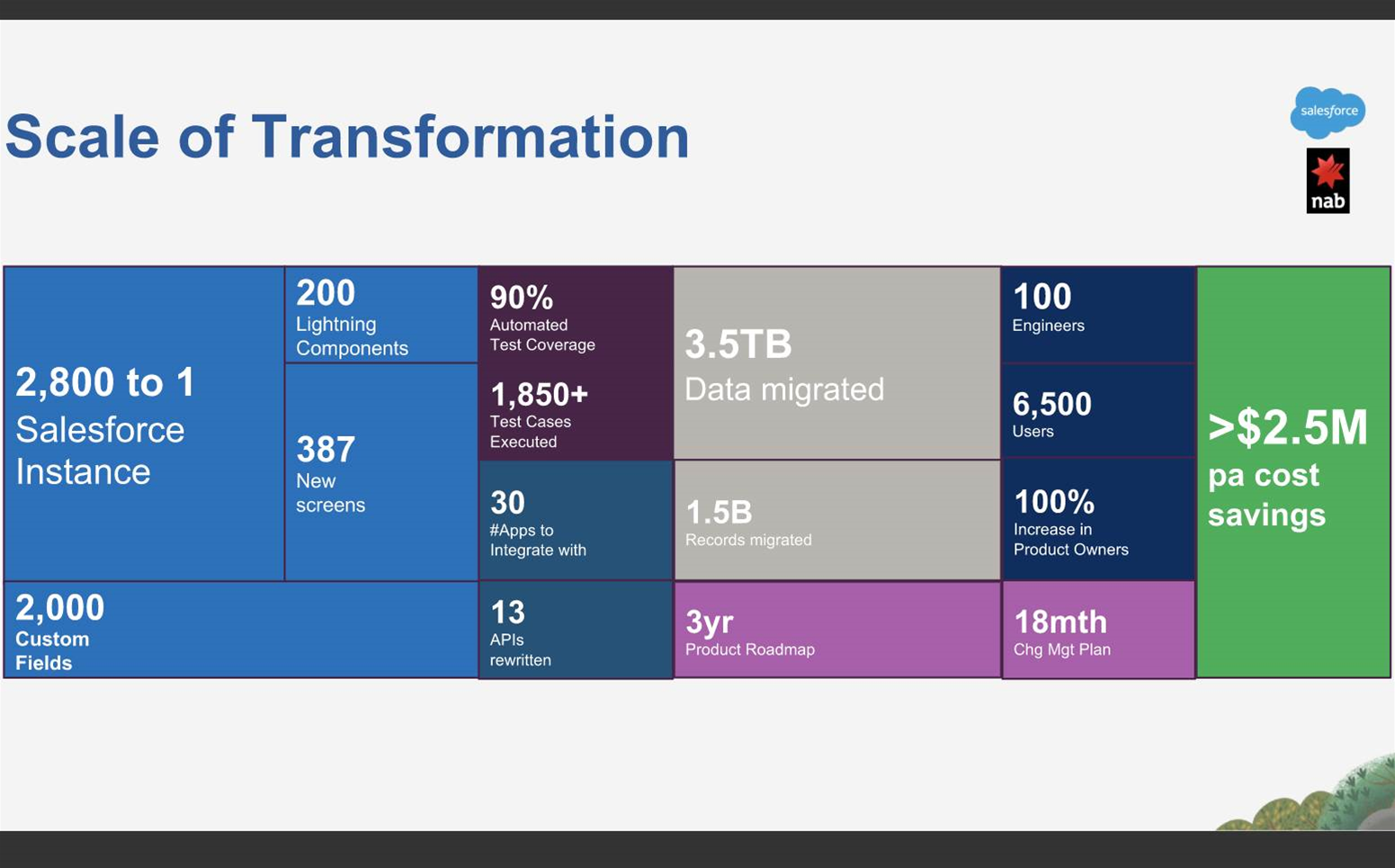

But it still had a major part of the project ahead of it - migrating 1.5 billion records, or 3.5TB of data in total - from 2800 brokers to live in the new Podium Reimagined platform.

The prior version of Podium comprised 2800 Salesforce “orgs” - effectively one instance of Salesforce for every brokerage.

At Salesforce’s Dreamforce 19 conference in San Francisco at the end of last year, NAB revealed this structure was largely a data ringfencing issue.

“The obvious question is why did [we] have so many orgs?” Podium digital product manager Dan McCoy told Dreamforce 19.

“When we started with Salesforce … they didn't have a way to segregate the data.

“Every broker business that we brought on is their own business and it's their data, so we had to segregate at an org level.”

As Podium grew - NAB says 17 percent of all loans written in Australia go through the platform - the complexity of that structure created issues.

“Unfortunately, with this legacy architecture came a lot of problems,” head of technology Stam Gonopoulos said.

“Complexity, which makes things very expensive to maintain and obviously support; reliability issues, [with] a lot of outages incidents [and] brokers not happy.

“It was slow as well so we had performance issues but to be honest, we were waiting for brokers to call us instead of practically fixing issues and end-of-life technology.”

“The word that our users used - and some of you might hear, too - is ‘clunky’,” McCoy added.

“Clunky can mean a lot of things: it was hard to navigate, and it felt like there was a lot of different systems all opening to get through [the broker’s] job and get through a loan application.”

Dealing with 2800 Salesforce orgs made even the thought of shifting to Salesforce’s newer Lightning UI “almost impossible,” McCoy said.

“Turning on Lightning was a massive exercise that we just couldn't get through,” he said.

Even simple changes became costly. “A good example is if I wanted to change a spelling mistake somewhere within the software it would start at $15,000,” McCoy said.

“We were also at quarterly releases, and it was an 18-hour outage.”

Another potential challenge was also looming in the form of a “hard limit of 3000” orgs in the way Podium had been set up.

Had NAB exceeded that number of brokers connected to Podium - and therefore orgs required, “that means we [would have] to repeat the whole pattern again. So it was time to change,” McCoy said.

Re-platforming Podium and then moving 2800 brokers - a total of 6500 users - across was a “phenomenal change management exercise,” Gonopoulos said, involving a project team of 150 people at its peak.

The last piece of work - and coincidentally “the most scary”, according to Gonopoulos - was a six month effort to extract data from the 2800 orgs and pull it across into Podium reimagined.

NAB ran the extract-transform-load (ETL) work “outside of Salesforce”, though it did not say what tools it used.

“[This was] 2800 businesses’ worth of data, all with a different data model, and [we] needed to converge to one standardized data model and do it in a time where basically the brokers weren't taken offline for too much [time],” Gonopoulos said.

“I'm glad to say we were able to deliver this: actually [late November 2019 was] our last and final migration.

“There's 700 hours of migration, so a very committed team working for 13 weekends to basically get through this volume.”

Experience alerts

While Podium Reimagined introduces a large number of changes, on the backend NAB “really invested” in putting monitoring and alerting against “key transaction [points] in the life of a broker”.

This was about staying on top of issues that might arise in the end-to-end experience that brokers had when using the platform.

Gonopoulos said monitoring was important because brokers often did not alert the bank to problems and simply looked for workarounds.

“There were 40 issues we resolved in the first month [of having monitoring] and these were issues that we didn't even know that,” he said.

“When a broker is using your platform, they won't sit there and every step of the way start calling you to tell you 'this is broken now'. They sort of start accepting some of the bad experience.

“Through this tooling, we were able to get notified in advance - and we continue to use this today and we actually have quite a decent backlog that we need to sort through.”

The payoff

Aside from broker experience and technical debt, the payoff of Podium Reimagined has also not been discussed.

McCoy noted that “across the whole banking network, 85 percent of new-to-bank customers” to NAB “come through this channel” i.e. mortgages brokered via Podium.

This was clearly a significant driver for the project, given NAB had seen its status in the loan market slip as Podium became outdated and was surpassed by easier-to-use platforms created by rivals.

At Dreamforce, NAB also put a dollar amount on savings from Podium Reimagined of greater than $2.5 million a year.

Ry Crozier attended Salesforce’s Dreamforce 19 conference in San Francisco as a guest of Salesforce.

_(20).jpg&h=140&w=231&c=1&s=0)

_(36).jpg&h=140&w=231&c=1&s=0)

iTnews Executive Retreat - Security Leaders Edition

iTnews Executive Retreat - Security Leaders Edition

iTnews Cloud Covered Breakfast Summit

iTnews Cloud Covered Breakfast Summit

Melbourne Cloud & Datacenter Convention 2026

Melbourne Cloud & Datacenter Convention 2026

The 2026 iAwards

The 2026 iAwards

_(1).jpg&h=140&w=231&c=1&s=0)