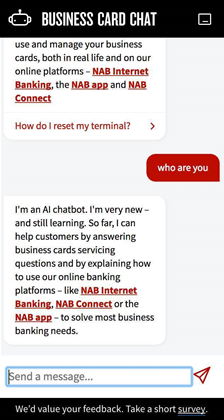

NAB business customers can now chat with a “virtual banker” over the web, which will eventually be able to respond to a range of more tricky account-related queries.

The bank said its chatbot service is now out of the testing phase and in pilot.

It can currently answer 200 common business banking questions with 13,000 variants, and explain how customers can use NAB’s online banking services and mobile apps, displaying walk-through videos for help with common tasks.

However the artificial intelligence chatbot is still in training, and falls back to humans if it doesn’t know the right response.

NAB chief operating officer Antony Cahill said the chatbot is aimed at making life easier for the bank's small to medium enterprise customers.

The chatbot launch follows the May arrival of the RoboChat service for NAB's UBank online-only subsidiary.

RoboChat is built around IBM’s Watson artificial intelligence technology, and can answer thousands of questions on 40 home loan topics such as terms and general conditions in real time.

_(33).jpg&h=140&w=231&c=1&s=0)

Cyber Resilience Summit

Cyber Resilience Summit

iTnews Executive Retreat - Security Leaders Edition

iTnews Executive Retreat - Security Leaders Edition

Huntress + Eftsure Virtual Event -Fighting A New Frontier of Cyber-Fraud: How Leaders Can Work Together

Huntress + Eftsure Virtual Event -Fighting A New Frontier of Cyber-Fraud: How Leaders Can Work Together

iTnews Cloud Covered Breakfast Summit

iTnews Cloud Covered Breakfast Summit

Melbourne Cloud & Datacenter Convention 2026

Melbourne Cloud & Datacenter Convention 2026

_(1).jpg&h=140&w=231&c=1&s=0)