ANZ Banking Group is to pilot a generative AI-powered upgrade of its Economic Pulse insights platform to help institutional customers engage more “intuitively” with its proprietary economic data.

The Gemini-backed version, known as Economic Pulse Plus, can respond to customer queries with insight summaries, visualisation charts and additional data related to Australian consumer spending.

Speaking at Google Cloud Summit in Sydney, ANZ head of data platform enablement Sathish Kannan said the upgrade will offer “a personalised data experience at scale with flexibility, speed, and intelligence”, in contrast to the more “static” interactions of the original Economic Pulse platform.

“Dashboards are great,” he explained. “It's a default option to visualise any data. But sometimes dashboards overwhelm users with too much information on metrics.

As such, Kannan said, the bank is looking to “redefine” the Economic Pulse experience, moving away from a “one size fits all” delivery while offering deeper insights.

“Our goal is to empower customers with dynamic data access, giving them the ability to define what insights they want to explore, how those insights are presented and the level of detail they require," Kannan said.

Economic Pulse Plus is built on Google Cloud Platform and uses BigQuery and Cloud Composer to “streamline” data pipelines and enable “scalable analytics” across the bank.

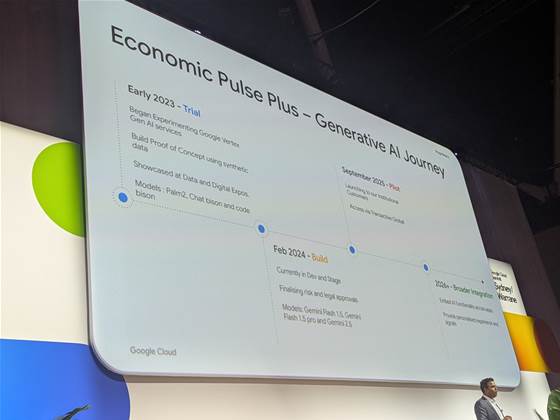

ANZ began laying the groundwork for the revamped service in 2023 when it began experimenting with Google’s Vertex AI suite to build a proof-of-concept using synthetic data and models such as PaLM 2, Chat Bison, and Code Bison.

The bank progressed to developing Economic Pulse Plus in February last year, now tapping the models Gemini Flash 1.5, Gemini Flash 1.5 pro and Gemini 2.5.

According to Kannan, the “whole application is built on an agentic architecture” with four “agents” working together.

The first is dubbed a ‘chart agent’, which receives and processes user queries. The queries are then sent to an ‘insights agent’, which translates the user’s natural language query into a database query (SQL). A 'reporter agent’ then summarises the data retrieved from the database into insights, while a ‘visualiser agent’ creates the charts or graphs.

Although still undergoing risk and legal approvals, ANZ is on track to launch the new app as a pilot in September this year for selected institutional customers via the bank’s enterprise banking app, Transactive Global.

Kannan also confirmed plans to extend the service across all ANZ applications over the next year.

Its development comes in tandem with that of ANZ’s planned “multi-agent chatbot” for bankers called amie.

Built on AWS, amie is styled as a “personalised markets analyst” that consolidates knowledge and can dispense it anytime.

_(33).jpg&h=140&w=231&c=1&s=0)

iTnews Executive Retreat - Security Leaders Edition

iTnews Executive Retreat - Security Leaders Edition

iTnews Cloud Covered Breakfast Summit

iTnews Cloud Covered Breakfast Summit

The 2026 iAwards

The 2026 iAwards

_(1).jpg&h=140&w=231&c=1&s=0)