With 7.3 million users and an estimated value of $39 billion, the BNPL giant is shaping how we spend in the accelerating ecommerce landscape.

Where is Afterpay based?

Afterpay is founded and based in Australia, with additional offices in San Francisco, California.

What exactly is Afterpay? — The answer in a nutshell

Afterpay is an Australian-founded BNPL service that was acquired by Square in August 2021 for $39 billion. It provides an alternative payment mechanism for customers, at checkouts of physical and online stores, that enables them to ‘buy now, but pay later’ in four equal instalments.

How does Afterpay work?

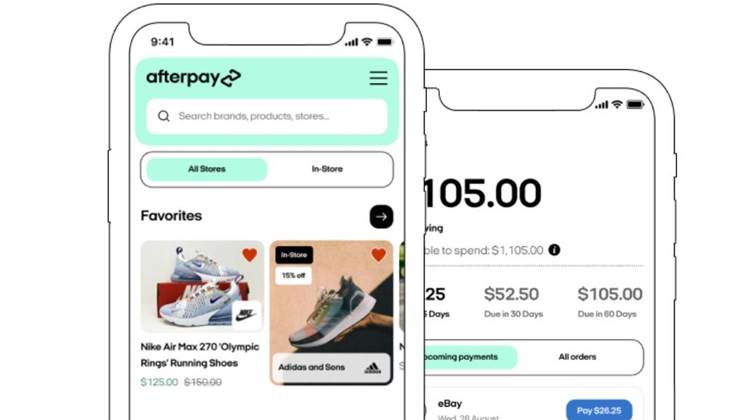

Through the creation of an Afterpay account and digital card, users can utilise the service with stores that accept Afterpay as a payment method. Users will then pay one of four equal instalments of the cost of the product, followed by an instalment every two weeks for the next six weeks. The instalments are interest-free with fees only charged when a payment is late.

The purchase of the product operates identically as it would for any other form of payment: shipping upon first instalment.

What is Buy Now Pay Later (BNPL) and why is it now so popular?

BNPL refers to services which allow users to spread out the payment of a purchased product in instalments over an agreed-upon length of time. The initial purchase is made by the buy now pay later provider, with each provider offering different rules and methods of repayment such as duration, cost of instalments plus fees for use of their service.

BNPL services appeal primarily to the millennial generation who comprise 75 per cent of Afterpays users. Splitting a purchase into four, smaller instalments provides users with greater budgeting flexibility and a credit card alternative while operating within the digital commerce sphere.

Who owns Afterpay?

Founded by Nick Molnar and Anthony Einsen in October 2014, the company was acquired by Square in a $39 billion stock deal to be settled by March 2022.

What are the alternatives to Afterpay?

How much does it cost to use?

Afterpay does not add interest to the four instalment payments. It does however charge late fees. For each order below $40, a maximum of one $10 late fee may be applied per order. For each order of $40 or above, the total late fees are capped at 25% of the original order value or $68, whichever is less.

Why has Afterpay been in the news?

The Square acquisition of Afterpay was set to create history as the largest deal in Australian corporate history. The move was also expected to create a boom in Australia’s fintech industry. However, news that BNPL services have recently been seeing their share price plummet has thrown the companies' future's into less positive territory.

_(23).jpg&h=140&w=231&c=1&s=0)

_(26).jpg&w=100&c=1&s=0)

iTnews Executive Retreat - Security Leaders Edition

iTnews Executive Retreat - Security Leaders Edition

_(1).jpg&h=140&w=231&c=1&s=0)