The Sri Lankan Government has offered Australian companies and Government departments a tax holiday of up to twelve years if they choose the war-torn country for IT and business process outsourcing.

Recovering from a 25-year civil war between the dominant Sinhalese and separatist Tamil movement that ended dramatically in 2009, the Sri Lankan Government has pulled out all the stops to boost employment and the country’s economy.

Foreign ownership laws have been relaxed across several key verticals in a bid to attract Western investment that might otherwise flow to India or China.

The Information and Communication Technology Agency of Sri Lanka has offered Australian companies setting up IT or BPO outsourcing “no restrictions on repatriation earnings” – a principle the agency says is enshrined in Sri Lanka’s constitution.

It has also lowered corporate tax rates from 35 to 28 percent, comparable to Australia’s company tax rate of 30 percent.

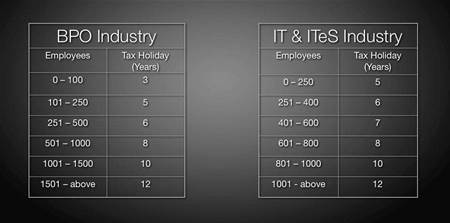

Under a new scheme proposed for the IT and BPO industries, businesses can be exempted from tax for up to twelve years when they commit to employing a large number of Sri Lankan workers.

The Information and Communication Technology Agency of Sri Lanka has funded a delegation representing 15 Sri Lankan ICT companies to visit Sydney and Melbourne for a series of events, including the CeBIT conference next week in Sydney.

Agency chief executive Reshan Dewapura said the small nation expects its IT industry to be a billion dollar export powerhouse employing 100,000 within five years.

“We are excited to extend a warm invitation to Australian companies to realise the significant opportunities that exist here, including generous tax holidays,” he said.

Read on to hear how one South Australian company took up the opportunity...

.png&h=140&w=231&c=1&s=0)

_(33).jpg&h=140&w=231&c=1&s=0)

iTnews Benchmark Awards 2026

iTnews Benchmark Awards 2026

iTnews Executive Retreat - Security Leaders Edition

iTnews Executive Retreat - Security Leaders Edition

iTnews Cloud Covered Breakfast Summit

iTnews Cloud Covered Breakfast Summit

The 2026 iAwards

The 2026 iAwards

_(1).jpg&h=140&w=231&c=1&s=0)