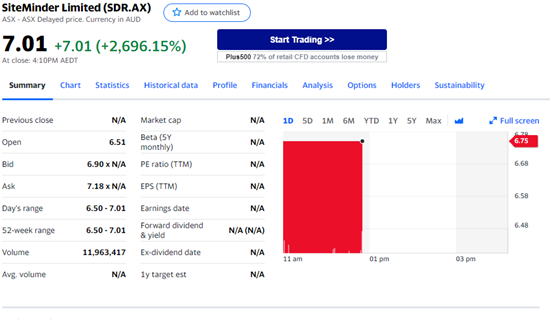

UPDATE: Shares in hotel commerce platform SiteMinder (SDR) surged 38.5 per cent on its first day of trading on ASX, ending the day at $7.01. It raised $627 million in an oversubscribed IPO.

For its initial public offering, 123,913,043 shares were offered at AU$5.06 per share, bringing its market capitalisation to $1.36 billion, based on the offer price.

The share price had jumped 35 per cent by 11 am this morning and then traded in a tight band for the rest of the day.

Investors have high hopes for the travel sector as countries around the world reopen borders and consumers shift their spending from 'stuff to experiences.'

According to SiteMinder CEO and managing director Sankar Narayan, “The global hotel industry has experienced evolution like never before in recent times. The need for technology like SiteMinder’s hotel commerce platform is of substantial relevance as hotels have had to digitally transform with haste, while adjusting to their customers’ changing needs and behaviours,” says Narayan.

“Today serves as yet another reminder that the world’s innovators and market leaders can emerge from Australia.”

BlackRock managed Equity funds led the IPO, along with key existing investors including AustralianSuper, Ellerston Capital, Fidelity International, Pendal Group and Washington H. Soul Pattinson. The IPO also so several new investors join the mix, including funds managed by Caledonia, GIC, UniSuper, Wellington Management, among others.

“We are grateful to our people, customers, partners and investors for supporting us on our 15-year journey so far. In particular, I am thrilled with the extremely high quality of shareholders who have joined us for our journey ahead. These include many of the biggest and most knowledgeable global and Australian giants in the investment world, to add to the very strong endorsement from our high quality existing investors.”

Today’s IPO follows the pre-IPO funding round in September, raising more than $100 million in primary and secondary capital.

While the business is headquartered in Australia, SiteMinder says that more than 60 per cent of revenue is generated outside the Asia Pacific region.

In the last year prior to the pandemic, the business generated more than 100 million reservations worth more than US$35 billion in revenue for hotels. These customers include, hotels and accommodation providers, including rentals, lodges, motels and enterprise properties.

_(20).jpg&h=140&w=231&c=1&s=0)

iTnews Executive Retreat - Security Leaders Edition

iTnews Executive Retreat - Security Leaders Edition

iTnews Benchmark Awards 2026

iTnews Benchmark Awards 2026

iTnews Cloud Covered Breakfast Summit

iTnews Cloud Covered Breakfast Summit

_(1).jpg&h=140&w=231&c=1&s=0)