PwC Australia is using Google optical character recognition and artificial intelligence services as part of a new tool called Zipline that makes it way simpler for clients to recognise and properly claim GST and VAT refunds.

Speaking at Google Cloud Next 19 in San Francisco, Brady Dever - a partner at PwC Australia specialising in indirect taxation - said that Zipline had only just emerged from a proof-of-concept in Australia.

But the consultancy has big plans for the tool: so big it's currently being localised for four international markets, including the EU, Canada, Singapore and India.

Ultimately, PwC expects the Australian-developed tool to be useful in 150 countries globally.

And while it is currently standalone, work is underway to allow Zipline to integrate with major enterprise resource planning (ERP) and expenses management platforms.

“We're in the middle of conversations right now with SAP Concur to actually have this as an ongoing sub-process within your employee expenses system … and having this ingrained as a sub-process for tax inside of ERP in the future,” Dever said.

Zipline has only existed even conceptually since July last year, when Dever and his PwC Australia colleague - financial advisory director Edward Knust - were exposed to a range of Google services at the last instalment of the Next conference.

“We started as an idea, as a thought bubble, nine months ago in July,” Dever said.

“Literally the next day [following the conference], we sat down with our Google partners and walked through some of our ideas.

“We were really fortunate that Google bought into this opportunity really early, and so a very short and intense journey started in July last year to get us to where we are today.”

The tool’s name - Zipline - has a double-meaning for those in the project.

First, Dever saw it as a “piece of technology to solve or bridge a gap that has existed and been a bugbear in my world as an indirect tax advisor and in my clients’ world trying to cope with indirect tax automation and systems”.

The alternative meaning is a Sydney-centric joke: Google and PwC are physically located on opposite sides of Pyrmont Bay.

“The PwC office and the Google office in Sydney is literally separated by 100 yards of water, and it takes us half an hour or 45 minutes to get across - but if we had a zipline we'd be there in two seconds,” Dever said.

Zipline - the tool - is used to automatically capture key information from invoice receipts from third party suppliers or employee receipts filed as part of corporate expense claims.

Once it captures the requisite information from the invoice or receipt, Zipline then works out how much of the GST (or VAT) amount is recoverable based on local tax rules.

Billions in refunds left on the table

Traditionally, Dever said, the application of local tax rules is done manually, often by accounts payable or a business process outsourcer.

“When a purchase is made, a purchase order is struck and an invoice is received - either a vendor invoice or an employee expense - somebody has to actually lift the data off those invoices, make a GST or VAT decision of what kind of expense it is, is it recoverable, and if it is recoverable, what code do I then apply to the transaction as I'm posting that transaction into the [core finance] system,” Dever said.

“Once the transaction is in the system, systems are very, very good at then automating how the GST should then flow through the accounts and then ultimately onto a return so that you can claim it back from the regulators.”

Dever said that the manual classification of invoices and receipts often led businesses to not claim back the full amount of GST or VAT they were entitled.

SAP Concur has researched the area of under-claims. “They estimate across the VAT world/GST world, there's around US$20 billion of VAT and GST on taxis, on hotels, flights, meals, that just goes missing,” Dever said.

“The reason why it goes missing is because businesses see these as low-cost purchases, though they do add up over time; and because the employees that are making reimbursement claims often need to make tax decisions off of the invoices. The risk of an employee selecting a wrong tax code is simply too high so businesses choose not to engage and claim that GST back.”

Dever said that system and process deficiencies often led to under or over-claims on GST and VAT.

In addition, he said, it made no sense for accounts payable or BPO organisations to be making tax decisions and processing documents for tax purposes, given some would not have been specifically trained in tax affairs.

“What this solution does is it scans the source document and works out from the source document based on a machine learning model that sits behind what kind of expense it is and if it is classified as a recoverable expense or a non-recoverable expense,” he said.

“That gap where you're relying on a non tax-trained person to make a tax call goes away. And that's where we see the real value.”

Unpicking the stack

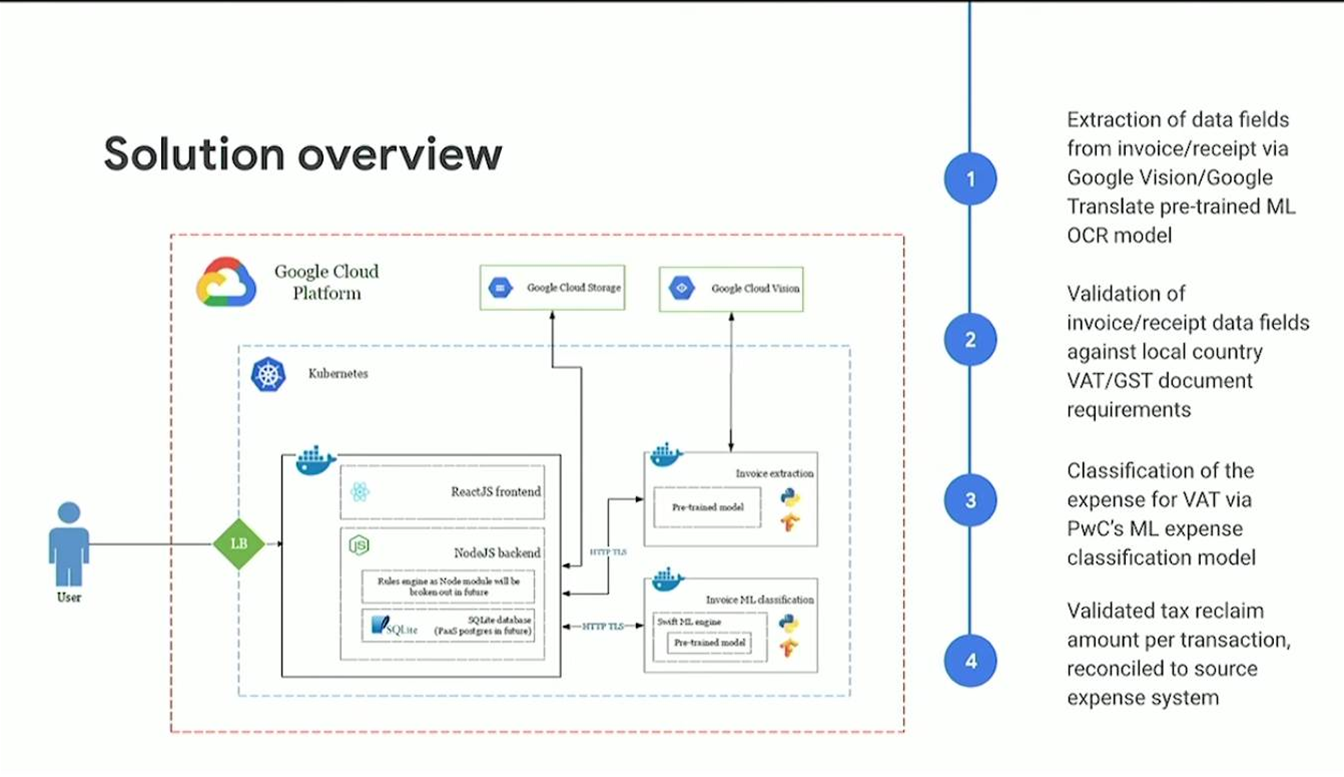

Invoices and receipts must first be uploaded into Zipline. It appears this will be done in two ways: either via a direct API into the source finance module (such as expense management), or by using a robotic process automation (RPA) bot.

Zipline uses Google Cloud’s Vision API to machine-read and extract data from the source invoices and receipts (a translation API is also used when the invoice isn’t in English).

It then uses a machine learning model to validate whether what's on that invoice meets local requirements, and therefore is a valid support document for the purposes of a GST claim.

Once that is done, PwC then runs its own machine learning models over the data to understand the type of expense being claimed.

“Different expense types are capable of different tax credits, so the capability we've built in here allows for an expense type determination and differentiation,” Knust said.

“Lastly, we get a validated tax reclaim amount per transaction line item. So if there hasn't been a booking in the underlying system, that will be the GST reclaim amount or VAT. If there has been, then we can reconcile the Zipline output with the underlying system output, and to the extent that there's a difference that can be investigated.”

Dever said Google’s OCR capability had proven to be more powerful than other systems PwC had explored.

“Unlike a number of other OCR providers, which take a template or grid-based approach to OCR where you teach the machine to look for things in certain quadrants of a document, the benefit of the Google technology is that because of the deep learning model that sits behind it, and the hundreds of thousands of documents that have sat in the training dataset, the tool keeps looking no matter where the data is located on a document to [pull out] the things that we need,” he said.

Dever also liked that smart logic could be applied to data as it was extracted from the invoices or receipts.

This is used to work out whether the document is valid from a proof perspective.

“It also does things like pings internet registers for tax authorities to validate that the seller is who they say they are, that their ABN or VAT ID is correct so they are genuinely registered. That matters in a lot of jurisdictions,” he said.

“It also validates the GST calculation or VAT calculations. So are we saying a $10 GST amount for a $100 purchase in Australia, where the GST is 10 percent.

“So it is doing a whole bunch of smart calcs using machine learning, based on tax rules and logic that PwC has co-created together with Google, to actually lift the data and do smart things to it on the invoice level.”

ML-based decisions

Dever and Knust demonstrated the ability of Zipline to determine different eligibility for GST refund claims based on what it could glean from the source invoice or receipt.

In one case, a hotel receipt of an Australian employee staying in Singapore was ingested. Zipline determined the invoice was valid but that the VAT amount was foreign and therefore “that the tax claimable is zero on the basis that it's not local tax.”

Knust noted that just capturing and classifying the invoice could open opportunities for companies with regional or global operations.

“Interestingly enough, there are a lot of cross border tax credit mechanisms. So even though it's not claimable within Australia, we can then report for potentially a Singapore reclaim where the client will be able to claim that VAT back in a separate tax return,” he said.

In a second example, a hire car receipt for an $83 fare was ingested by Zipline.

“In Australia, we have a rule that anything above $82.50 requires certain requirements that aren't required under that threshold,” Knust said.

“One of the requirements is it must have the term ‘tax invoice’ at the top.”

As the example invoice did not carry those words, Zipline deemed it invalid as evidence to make a claim.

Recognising these types of instances could be important to companies, since they could approach suppliers with non-compliant invoices and seek changes.

“Here we've paid tax out, we do have an implicit right to claim it if we have a valid document, but for whatever reason we don't hold that document. If we did we'd get the tax back,” Knust said.

“This is a massive gap in our client base where they're paying substantial amounts of tax out but the document is not valid.”

On a third example, Zipline was able to recognise that no GST was paid on an airfare purchase, and therefore none could be reclaimed.

Knust said this type of recognition was valuable to companies because airfare purchases did not uniformly include indirect taxes.

“One of the risks with previous solutions is that when you have a category like airfare, which could potentially contain tax or not depending on whether its domestic versus international travel, if you automatically assigned a tax credit calculation to that airfare category, you may have imputed a tax credit in cases where there was no tax paid,” he said.

“By going to the source document and validating it, we take out any risk that the underlying classification of that expense type may have been incorrect.”

A fourth example applied Zipline to an entertainment expense - a high restaurant bill.

“The logic that's applied within the machine learning model of looking at the vendor type, of looking at the spend and the location, has been able to determine that rather than being a general expense, this is an expense of an entertainment nature,” Knust said.

“In most VAT jurisdictions, entertainment has a restricted recovery, because the tax office doesn't want you to be able to go out and have a high value lunch or dinner and claim all the tax back.

“So here we've identified that it falls within that category, it is a valid document, so when it comes to the VAT claimable amount we've been able to apply the relevant local rule for restriction. We only have a 50 percent right to recovery of entertainment expenses.

“This again is one of those scenarios where if you're an accounts payable clerk or an individual trying to do a classification in an expense type which is not subject to full recovery, that gets very, very tricky.”

Taking it global

Now that it has passed proof-of-concept in Australia, Zipline is being prepared to handle indirect tax claims in 150 countries in which PwC operates.

Dever and Knust are also exploring an expansion of the tool to handle other types of use cases.

“Our clients are always challenging us with new ideas,” Dever said.

“The obvious one to us is any other tax applications where the underlying document is relevant for tax classification, so we're talking about withholding tax, stamp taxes, sales taxes, or instances where you're having to make an opex vs capex decision which has a tax impact.

“More broadly in finance process automation, many of our clients are going through cloud ERP upgrades, such as to S/4 HANA, and this is the perfect time for them to do that last leg of automation, which isn't necessarily available within those cloud ERP suites.”

Dever noted other parts of PwC had also expressed interest in Zipline.

“We've started to work together with some of our own forensics and analytics teams outside of tax, complementing some existing processes around loan document analysis for banks and expense fraud analysis - just given the power of the data that we've got in this model,” he said.

“We see this as a little humble indirect tax solution that has much much greater application outside of indirect taxes and huge potential for our clients.”

_(23).jpg&h=140&w=231&c=1&s=0)

iTnews Executive Retreat - Security Leaders Edition

iTnews Executive Retreat - Security Leaders Edition

iTnews Benchmark Awards 2026

iTnews Benchmark Awards 2026

iTnews Cloud Covered Breakfast Summit

iTnews Cloud Covered Breakfast Summit

The 2026 iAwards

The 2026 iAwards

_(1).jpg&h=140&w=231&c=1&s=0)