NBN Co should be prepared to "overbuild" up to 70,000 km of monopoly backhaul links at a cost of $3.5 billion - except in places where long-term leases on existing dark fibre assets can be secured, according to the NBN Implementation Study released today.

The network builder should also roll out an additional 3,500 km of backhaul to connect to fixed wireless towers, the study said.

Study authors McKinsey & Co and KPMG said the figures were based on "geospatial modeling".

They also said the $3.5 billion recommendation did not take into account any future deal between NBN Co and Telstra, despite "strong commercial logic for both... to share infrastructure".

"While the logic of an infrastructure-sharing agreement is compelling for NBN Co and for Telstra, it is not assumed in our expenditure modeling," the study said.

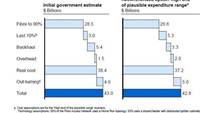

"We have modeled an overbuild of approximately 70,000 km of backhaul for an estimated cost of approximately $3.5 billion."

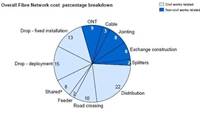

Between 70 and 75 percent of the cost - $2.45 billion - would be for passive infrastructure like ducts. The rest was for active equipment.

The $3.5 billion cost assumed, among other things, that trenches and ducts would be shared in places where the transit and access networks overlapped.

While NBN Co should be prepared to build, they should also be "open to securing long-term indefeasible rights of use from existing dark fibre assets on these routes.

"Although the construction of all necessary backhaul links is viable and would provide complete assurance of availability, it would be expensive and economically inefficient since most of the required infrastructure already exists," the study said.

"NBN Co should therefore seek commercial arrangements providing guaranteed access to existing dark fibre, where this is economically preferable to constructing a new network."

No privatisation, please

The study's authors did not back the privatisation of NBN Co's backhaul assets, believing the network would be best left in public hands.

"This shared backhaul network is most appropriately run as a public asset over the long term due to the risks of anti-competitive behaviour in a privatised model," the study said.

"The NBN backhaul will have strong natural monopoly characteristics and is unlikely to ever face competition on most links in either the active or passive part of the network."

The authors recommended an independent competitive review be undertaken prior to any push by the Government to privatise the NBN.

But even then, "this review should start with a presumption not to privatise backhaul," the study said.

$4.50 backhaul?

Stakeholder interviews by the study's authors found backhaul sometimes represented up to 20 percent of an ISP's operating costs.

ISPs will be pleased to know there are recommendations to change all that.

"The price of transit backhaul services attributable to a single premises' access service [should] be not more than a certain percentage of the retail price of a typical entry-level NBN wholesale broadband product," the study said.

"Government [should] define the percentage, preferably not more than 10 percent."

The study said that backhaul should cost "less than $4.50 [in] a $30 wholesale service" in order "to achieve affordability in all geographies."

"This would equate to approximately 10 percent of an expected entry-level retail broadband service," the study said.

"At 20 percent of the retail price, it would be difficult to have consistent retail prices and be profitable in regional areas - leading to less retail participation, lower end-user take-up and lower NBN Co revenue."

Lower entry barriers

ISPs could also win if NBN Co meets a recommendation to lower the number of customers needed to make entry into a fibre exchange viable.

"In the present DSL market, ISPs use 150-200 subscribers as a rule of thumb for when it is commercially viable to enter an exchange, when affordable backhaul is available," the study said.

"NBN Co should strive to make backhaul viable for ISPs with around 100 subscribers."

Open access to transit backhaul

The study also suggests that mobile or WiMAX ISPs be able to use the NBN backhaul as a transmission network.

According to the study, "there is no commercial or technical reason" why that can't happen - although the authors later concede there could be commercial reasons not to in the short term.

"In the immediate term, there are practical reasons why Government may choose not to make transit backhaul available to other network owners," the study said.

"This includes the operational complexity of forecasting unpredictable demand from alternative networks and the commercial imperative to drive early take-up of NBN services.

"Accordingly, some temporary relief for NBN Co to not be required to offer standalone transit backhaul could be appropriate.

"[But] in the long-run, NBN Co should offer open access to the backhaul network to stimulate competition on all access technologies, not only FTTP (fibre-to-the-remise)."

_(28).jpg&h=140&w=231&c=1&s=0)

_(20).jpg&h=140&w=231&c=1&s=0)

iTnews Executive Retreat - Security Leaders Edition

iTnews Executive Retreat - Security Leaders Edition

iTnews Benchmark Awards 2026

iTnews Benchmark Awards 2026

iTnews Cloud Covered Breakfast Summit

iTnews Cloud Covered Breakfast Summit

The 2026 iAwards

The 2026 iAwards

_(1).jpg&h=140&w=231&c=1&s=0)