British banks will from 2018 have to share customers' data with third parties who can then show how much could be saved by using other lenders, the competition watchdog has ruled.

New banks, consumer advocates and lawmakers, however, derided the plans as relying too much on people's ability and willingness to use new technology.

Customers are paying more than they should for banking and are not benefiting from new services, the Competition and Markets Authority (CMA) said in its final report after a three-year review of consumer and small business banking.

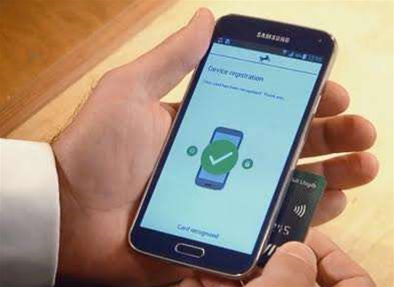

Financial technology, or "fintech", companies are expected to offer smartphone apps and websites that use customers' information to enable them to compare bank charges. The CMA believes setting a 2018 deadline will also boost the "fintech" sector.

The government wants to see fintech grow, but European Union countries like Germany would like to lure the sector from London after Britain voted to leave the bloc.

"This is a real opportunity for the UK to take the lead. We are going to make it happen and give it a push to get it across the line," Adam Land, a senior director at the CMA, said. "There is no question that fintech companies are champing at the bit."

High street banking in Britain is dominated by the "big four" lenders - Lloyds Banking Group, Royal Bank of Scotland, Barclays and HSBC - which control more than three quarters of current accounts and provide nine out of 10 business loans.

Only 3 percent of consumers and 4 percent of business customers change banks in any year due to inertia.

Not giving up

Andrew Tyrie, chair of parliament's Treasury Select Committee, which has pushed for six years to get more competition in banking, said he was not optimistic the measures will get to the heart of the problem.

The measures rely on new technology to do the heavy lifting while customers were understandably wary of sharing data, and the committee will ask the CMA to justify its proposals in the autumn, he said.

"We are not giving up now," Tyrie said.

Under the new rules, banks will have to share a customer's data with third parties, providing the customer agrees.

.png&h=140&w=231&c=1&s=0)

iTnews Executive Retreat - Security Leaders Edition

iTnews Executive Retreat - Security Leaders Edition

iTnews Cloud Covered Breakfast Summit

iTnews Cloud Covered Breakfast Summit

The 2026 iAwards

The 2026 iAwards

_(1).jpg&h=140&w=231&c=1&s=0)