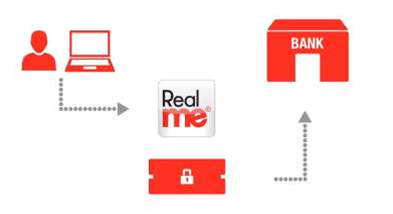

New Zealand banks will use the government-backed identity verification scheme RealMe for online banking services, the country's minister of internal affairs, Chris Tremain, announced yesterday.

According to Tremain, local financial institutions Kiwibank and TSB Bank have confirmed they will offer RealMe verification for their customers.

Westpac also intends to introduce RealMe, along with a number of other major Australian banks operating in New Zealand.

Apart from providing a high degree of confidence in proving users' identity online, Tremain said RealMe enables banks to meet their obligations under the country's new anti-money laundering and countering financing of terrorism law.

RealMe kicked off on July 1 this year, and is run by New Zealand's Department of Internal Affairs and NZ Post.

The service does not store information in a central database, but instead draws it from others such as the register of births and deaths and is said to be designed with security and privacy in mind.

It replaces the former iGovt logon to access some forty different government services such as applying for passports and dealing with taxation authorities through a single username and password.

Law changes last year allows private companies to use the government online identification service, and Tremain said he hopes to see further commercial use of RealMe in the future.

_(33).jpg&h=140&w=231&c=1&s=0)

_(20).jpg&h=140&w=231&c=1&s=0)

iTnews Benchmark Awards 2026

iTnews Benchmark Awards 2026

iTnews Executive Retreat - Security Leaders Edition

iTnews Executive Retreat - Security Leaders Edition

iTnews Cloud Covered Breakfast Summit

iTnews Cloud Covered Breakfast Summit

The 2026 iAwards

The 2026 iAwards

_(1).jpg&h=140&w=231&c=1&s=0)