You don't need to dive too deep into the records at HP-owned Autonomy to realise the software company's method of reporting is problematic.

A few weeks ago I presented at a conference in New York under Chatham House rules.

My topic: how to fake your accounts from the perspective of the fraudster (and hence how as an investor to tell if a company is faking its accounts).

At the end of the presentation I suggested that even if you were right and the company was a fraud you could still short the stock and lose money — someone with deep pockets might buy the fraud. The example I gave was software company Autonomy, which was purchased by Hewlett Packard.

Last week, Hewlett Packard admitted that Autonomy was a grotesque fraud. They wrote off most of the purchase price.

Chatham House rules don't much matter in the face of a major scandal (and Autonomy is a major scandal).

I could tell the accounts were not kosher from an office in Sydney. I was not alone ... and I was not entirely right either.

I knew Autonomy was problematic. But I underestimated the problems: Autonomy appears worse than the worst case I modelled.

For the record here is how you could tell — just by looking at audited accounts — that Autonomy was not quite kosher.

Here is the P&L from the 2010 accounts:

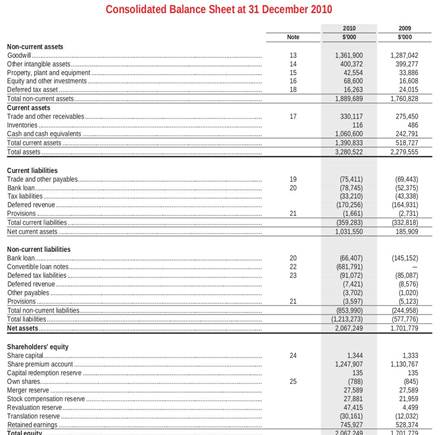

And here is the balance sheet:

There are lots of things to note - but I will limit myself to the most obvious.

Sales were $870 million.

Receiveables were $330 million — which is four and a half months of receiveables.

Deferred revenue is $177 million — just over half of receiveables.

This is really perverse for a software company. Software companies sell stuff that is barely tangible — they sell it up front and for cash. They have very few receiveables.

They do, however, have an obligation to service that software for a long time after they sell it —so the unearned income is relatively large (usually a multiple of receiveables).

Autonomy was booking as income lots of cash it had not received (which is why the receiveables were large) and not booking any obligation to provide future services for that income.

This is prima-facie suspect (and you could tell simply by looking at the balance sheet). All it required was basic applied accounting.

HP's management

The management (and for that matter, the board) of Hewlett Packard have diverse responsibilities.

Most importantly they are responsible for technology - and the technological issues are broad. They are also responsible for accounting and financial management.

I have simply no opinion on who stuffed up on the technical issues. Hewlett Packard asserts there are still some (small but) valuable businesses at Autonomy. Maybe the tech is not all bad.

But I am happy to point the finger on accounting. The accounts were self-evidently suspect.

Working that out is primarily the job of a finance and accounting function at Hewlett Packard — and that function was led by and continues to be led by Catherine Lesjack.

Catherine Lesjack is ultimately responsible for the financial parts of HPs due diligence on Autonomy and she failed.

This really is not rocket science. Lesjack is not up to the job. She should resign.

This article is an adaptation of a blog post by John Hempton, the Sydney-based founder of Bronte Capital Management. Hempton blogs about the good, the bad, and the ugly of the financial markets.

_(20).jpg&h=140&w=231&c=1&s=0)

.png&h=140&w=231&c=1&s=0)

iTnews Executive Retreat - Security Leaders Edition

iTnews Executive Retreat - Security Leaders Edition

_(1).jpg&h=140&w=231&c=1&s=0)