Australian listed software solutions provider Reckon has hired Macquarie Capital to help it assess its 'strategic options' after a report of a potential offer for the company sent its share price soaring.

Reckon was forced to reveal its hand after the AFR's Street Talk today reported the software firm had been approached by a private equity or trade player in recent months.

The report sent Reckon's share price up over 9 percent to a high of $2.11 at the time of writing.

The stock movement prompted the company to confirm to its shareholders it had engaged Macquarie Capital to assess its options.

"At present this process is at a stage where it is indefinite and incomplete and there is presently no information which merits disclosure under the listing rules," it advised.

"Reckon will notify the market in the event that further disclosure is required."

It said it would not comment on "market rumours or market speculation".

Over the past 12 months Reckon's share price has hit a high of $2.25, where it normally trades around $2. The company has a market capitalisation of $235.4m.

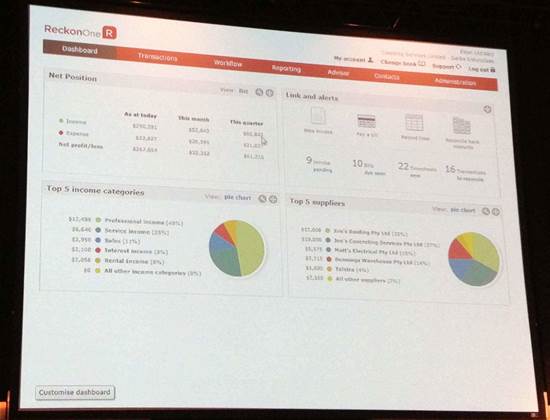

Reckon provides accounting software to small to medium businesses, small/home office users and bookkeeping professionals. It listed on the ASX in 1999.

_(20).jpg&h=140&w=231&c=1&s=0)

_(36).jpg&h=140&w=231&c=1&s=0)

.png&h=140&w=231&c=1&s=0)

iTnews Executive Retreat - Security Leaders Edition

iTnews Executive Retreat - Security Leaders Edition

Huntress + Eftsure Virtual Event -Fighting A New Frontier of Cyber-Fraud: How Leaders Can Work Together

Huntress + Eftsure Virtual Event -Fighting A New Frontier of Cyber-Fraud: How Leaders Can Work Together

iTnews Cloud Covered Breakfast Summit

iTnews Cloud Covered Breakfast Summit

Melbourne Cloud & Datacenter Convention 2026

Melbourne Cloud & Datacenter Convention 2026

The 2026 iAwards

The 2026 iAwards

_(1).jpg&h=140&w=231&c=1&s=0)