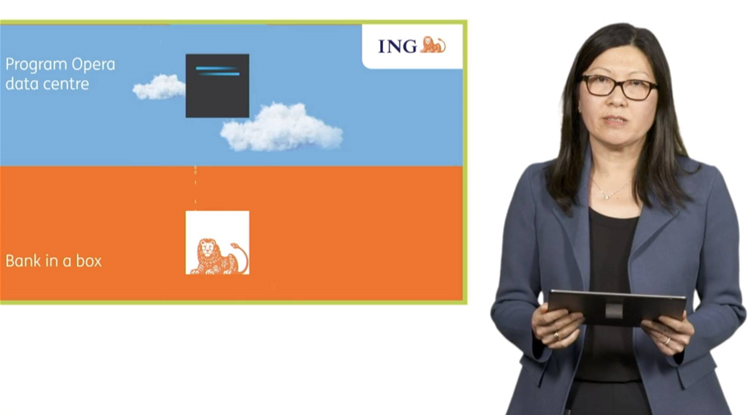

ING Australia is in the midst of an infrastructure transformation that will see it stand up two new data centres and a private cloud environment.

Chief information officer Linda Da Silva told FST Media’s Future of Financial Services summit that the transformation, known internally as Program Opera, is “well underway”.

“[It] will introduce two new modern data centres and private cloud technology,” Da Silva said.

“Container technology will modernise our systems landscape and decommission legacy assets.

“We'll leverage our microservices architecture, improving time to market, elasticity and resilience of our systems.

“We've also introduced new monitoring technologies, focused on taking an outside-in approach, which is looking at a problem from a customer or an end user perspective in the way we observe and deal with technology challenges.”

Da Silva said Opera - as well as ING Australia’s broader technology strategy - is anchored around the bank’s vision for growth, as well as its desire to “deploy really simple solutions to our customers”.

“Program Opera is [designed] to ... build us a very strong foundation in order to support the growth path that we're heading on,” she said.

Da Silva said ING Australia, as "the country’s first branchless bank", had a "digital DNA at its core".

“We're a very metricised organisation as well,” she said.

“We look at internal and external SLAs and we measure everything, which gives us a lot of data and insights to then be able to address areas of concern but also predict areas of growth or challenges that we face.”

ING Australia has long been able to use what it calls ‘bank-in-a-box’ to enable fast software changes to its digital bank environment.

Bank-in-a-box provides the capacity to replicate a virtual instance of the banking platform for developers to patch, modify or extend in an isolated sandbox.

“This technology provides our delivery squad with an on-demand copy of our digital bank for their development and testing,” Da Silva said.

“We've also scaled this capability into the public cloud to allow for even more capacity.

“With Opera, we'll continue to enhance our pipeline approach to allow for on-demand production releases and canary releases, where we deploy solutions to a small number of customers to assess the experience before releasing it to all.”

Outside of Opera, Da Silva also talked up the bank’s use of artificial intelligence, automation and [software] robotics technology, particularly during the COVID period.

“We've done this in the mortgages and the consumer lending space to speed up processing approval times and cycle times,” she said.

“With COVID-19, we've also accelerated our use of robotics to solve problems directly caused by the pandemic. For example, we've introduced robotics to our collections team, so they could identify COVID related cases and address them as a matter of priority.

“We've also introduced robotics into our process of helping customers apply for assistance with their loans, and this really helped to reduce customer queue times.”

_(23).jpg&h=140&w=231&c=1&s=0)

.png&h=140&w=231&c=1&s=0)

iTnews Executive Retreat - Security Leaders Edition

iTnews Executive Retreat - Security Leaders Edition

iTnews Cloud Covered Breakfast Summit

iTnews Cloud Covered Breakfast Summit

Melbourne Cloud & Datacenter Convention 2026

Melbourne Cloud & Datacenter Convention 2026

The 2026 iAwards

The 2026 iAwards

_(1).jpg&h=140&w=231&c=1&s=0)