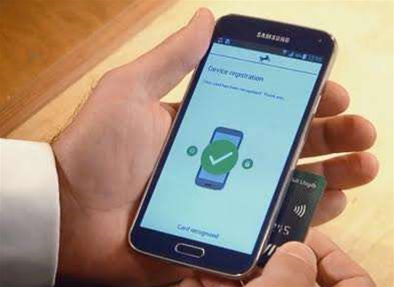

Britain's Lloyds Bank is testing whether near-field communications (NFC) can be used to effectively and securely authenticate a customer's identity when setting up mobile banking.

Around 125 people have participated in the organisation's 'tap to bank' trial, which involves tapping a Lloyds Bank card equipped with an NFC chip against a customer's NFC-enabled Android smartphone for instant authentication.

It removes the need for the customer to wait for a phone call from an automated system and go through the process of registering for mobile banking.

The bank said the trial had found most of the participants considered the new approach "simpler, quicker and easier to use". The testing also indicated the technology could be used in other areas, such as new payment authentication, the bank said.

Lloyds is also offering a new authentication process for certain tasks within deskop internet banking.

Rather than wait for a phone call, customers can verify a request - such as setting up new beneficiaries, standing orders, making international payments or resetting internet banking passwords - by logging in to their mobile banking app.

According to the bank, this method of authentication takes less than 20 seconds to complete - "a lot quicker" than the automated phone call approach, it said.

"The potential for the process failing is also reduced, removing issues such as network connections dropping due to a lack of signal for calls," the bank said.

The new authentication process is currently only available to Android users, but the bank has previously said it will support Apple Pay when the payments solution lands in the UK.

It claims to have 2.5 million active mobile banking users.

Lloyds Bank has previously promised to invest £1 billion (A$1.5 billion) into its digital capability over the next three years.

Following the international group's decision to focus on its UK business in 2013, Australian bank Westpac bought Lloyd's local asset finance business CFAL and its BOSI corporate loan portfolio for A$1.45 billion.

_(28).jpg&h=140&w=231&c=1&s=0)

_(33).jpg&h=140&w=231&c=1&s=0)

iTnews Executive Retreat - Security Leaders Edition

iTnews Executive Retreat - Security Leaders Edition

iTnews Cloud Covered Breakfast Summit

iTnews Cloud Covered Breakfast Summit

Melbourne Cloud & Datacenter Convention 2026

Melbourne Cloud & Datacenter Convention 2026

The 2026 iAwards

The 2026 iAwards

_(1).jpg&h=140&w=231&c=1&s=0)