Australian neobank hopeful Xinja has bedded down its SAP S4B core banking system and started limited closed tests of its first deposit product, ahead of what it hopes will be approval to operate before the end of the year.

Xinja committed to deploy an SAP core hosted in SAP’s cloud back in mid-August. It is using S4B - or SAP integrated banking package on S/4HANA, a two year old product that the vendor created for the challenger banking sector.

The relatively quick bedding down was achieved in part because Xinja has no IT legacy to contend with, but mostly because of the way S4B comes packaged from SAP.

“Unlike all other implementations where you configure from scratch, S4B arrives with a preconfigured bank configuration,” co-founder and director of enterprise delivery Peter Makris told iTnews.

“Because we’re a new company we made sure we did no modifications to the core. We made sure any differences we required from SAP were dealt with in process engineering outside the core bank or in customisation in our microservices layer or other areas in our architecture.

“We keep the cost of ownership of SAP as low as possible with minimum customisation.”

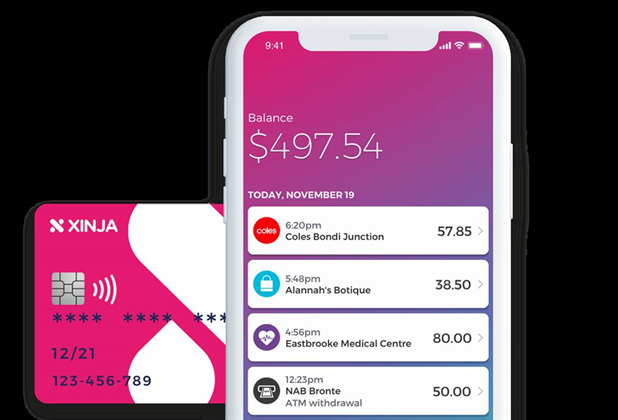

Xinja is one of several neobanks hoping to be granted a new restricted banking licence by the Australian Prudential Regulation Authority (APRA).

“What we’ve done [to date] is a technology go-live. We’re still waiting for a market go-live, pending the licence, but we’re live in production with the technology,” Makris said.

“We’ve got all our interfaces up and running. We aren’t running customer accounts yet pending the licence approval.

“We’ve done full end-to-end implementation testing and we’re now … doing very limited production testing but not live to the market.

“We’re ready to go when the time is right, subject to the regulatory environment.”

Though APRA is taking a keen interest in the robustness of neobank IT systems, Makris noted that interest is expressed through “standards and guidance”, as well as ensuring the newcomers “know the risks and understand how to mitigate them”.

Makris believes a core built on SAP puts Xinja in a good place for meeting “the very strict regulatory standards around security and infrastructure hosting” that, in part, will determine whether the challenger is able to get its restricted licence.

“There’s some pretty big ADIs [authorised deposit-taking institutions] in Australia using SAP as their core banking platform,” Makris said. CBA is one of the largest with an SAP core.

“That’s important to us in terms of them having made modifications for the Australian market for localisation purposes.

“Those use cases have been very top of mind for us. A lot of emerging [alternatives to SAP] didn’t have the domestic track record in tier one ADIs.”

With the core in place, Xinja is forging ahead with building out its microservices layer, which will underpin the financial products it ultimately hopes to bring to market.

“We’ve got a robust and thought-through technology strategy and architecture and that leans into the roadmap for our licence,” Makris said.

“We’ve got the infrastructure and application cores in. We’re now building out the general ledger and our regulatory reporting capabilities, and also extending out our payments capability. We’ve got some basic payments capability now but we’re extending that to be much richer.

“A lot of that has been woven together by our microservices layer. That’s where the innovation [for future financial services] is happening.”

Also this week, Xinja appointed Tesla senior engineer Thomas Vikstrom to the neobank’s board.

.png&h=140&w=231&c=1&s=0)

_(28).jpg&h=140&w=231&c=1&s=0)

iTnews Benchmark Awards 2026

iTnews Benchmark Awards 2026

iTnews Executive Retreat - Security Leaders Edition

iTnews Executive Retreat - Security Leaders Edition

iTnews Cloud Covered Breakfast Summit

iTnews Cloud Covered Breakfast Summit

The 2026 iAwards

The 2026 iAwards

_(1).jpg&h=140&w=231&c=1&s=0)