By now you would have read what every person connected to the internet thinks about the iPhone 6.

So, armed with a few iPhone 6 review units and a Telstra 4G sim, iTnews decided to do something a bit different and give our readers the chance to review the device.

Given the new iPhone will offer an NFC-based mobile payments service, we took to mobility experts within Australia’s biggest banks to find out if the devices impressed the financial sector.

Apple Pay

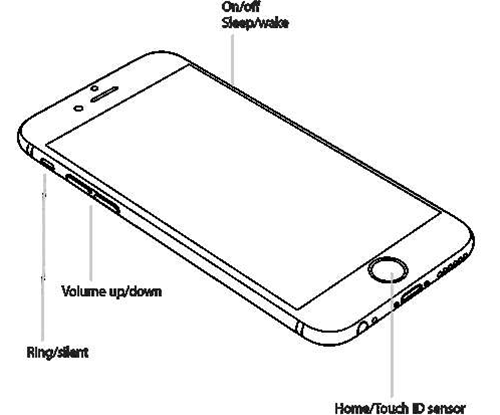

The Apple Pay service will launch in the US in October. The system involves an embedded NFC chip, a secure element to store encrypted payment details, Apple’s TouchID fingerprint technology, and its existing Passbook application.

To make a payment, the user swipes their iPhone over a compatible merchant terminal at point of sale, the iPhone brings up a prompt for payment, and the buyer is asked to choose which credit or debit card (stored within Passbook) to pay with. The transaction is then authenticated using TouchID.

As with PayPal, the vendor is not able to view the buyer’s credit card or personal details - Apple Pay generates a “dynamic security code” for each individual transaction to keep the buyer’s personal details private from the retailer.

It is a function that has been available for some time in Samsung devices running the rival Android mobile operating system, but despite huge demand had not been included in Apple phones until now.

While six major US banks and a number of retailers alongside American Express, Visa and Mastercard have all signed up to Apple Pay, the company has refused to provide details on when - and if - the payments service will arrive in Australia.

It’s frustrating for Australia’s biggest payment institutions, who are now being dangled a carrot after having to resort to solutions like NFC-enabled cases and stickers for iOS users in the absence of a solution from Apple.

When Apple Pay does eventually arrive locally (likely the end of next year) and Australia’s banks are given access into Apple’s Passbook app, its very likely CommBank will be able to ditch its sticker-based payments solution, Westpac can expand its NFC activities beyond Samsung's Android devices, and NAB and ANZ will be able to properly join the NFC race.

For Westpac’s chief engineer of mobility and channels, Eugene Zaid, Apple Pay is the function of most interest within the new phones.

Westpac earlier this year began offering Samsung Galaxy S and Note 3 users the ability to make wave-and-go payments using the devices’ embedded NFC chip and secure element at Visa payWave terminals.

But it’s been forced to wait to be able to do the same for Apple devices.

While Zaid was pleased Apple has now finally adopted the technology, he doesn’t expect to see a huge take-up of the service just yet - he thinks broader merchant support is needed first.

“As always, the problem is to make everyone comfortable with the service, not just the early adopters," he said.

Apple has also locked its Pay service from use by third parties - meaning the NFC technology cannot be used for other functions. That's a decision Zaid would prefer to see reversed.

He said the technology could prove useful in other authentication situations, such as for internal staff productivity applications and systems.

ANZ Bank has been one of the slower movers in the NFC-based payments space.

The Melbourne-based bank has previously trialled NFC with Samsung’s Galaxy S 3 internally in a limited capacity, as also played with contactless iPhone payments using a third-party case. But ultimately ANZ decided to wait until the market was ‘more mature’ and the technology available to the majority of customers before proceeding further.

The inclusion of NFC in Apple’s latest iPhone will push ANZ closer to developing a solution, but the bank is still not convinced the market is ready. That said, it is taking a keen interest in the new technology.

ANZ’s general manager of innovation Peter Dalton said the bank had shied away from the stickers and cases offered by competitors because it believed such solutions would not provide a better experience than that on offer by contactless cards.

“Stickers and cases cause more friction for customers," he told iTnews. "It’s simply not as fast and secure as tapping with a contactless card. We’ve been investigating but we’re waiting until the user experience is better than that, and until the technology is on as wide a number of handsets as possible.

“We expect to see more movement in the next two years, when you can put an ANZ card on any device with any telco and it can as simple and as secure an experience as with the contactless card.”

ING Direct has also held off offering any sticker or case-based NFC solutions for two reasons, according to head of digital and emerging channels Janelle McGuinness. First, such solutions don’t allow for more than one card to be used, and further, the vast majority of ING Direct’s mobile customers use iOS devices.

“Combining NFC with authentication is something the industry has been waiting for Apple to do,” McGuinness said.

She’s been exploring ING’s options while waiting for Apple to get a move on. The bank is currently trialling a limited amount of NFC stickers internally - but for her, it’s about waiting to see how Apple Pay turns out given the preferences of the bank's customers.

McGuinness also expects that, despite Apple’s announcement that Pay will not be opened to third-party developers, Apple will eventually unlock the service to external parties as it has done with TouchID and other widgets.

A new, open TouchID

While the banks are keen to start discussions with Apple on its payments service, it’s not the only feature that caught their attention in the release of iOS 8.

Apple’s decision to allow third-party developers to use the company’s TouchID fingerprint technology is likely to see a number of Australia’s banks look at how the technology can be used both within their internal businesses and also in interactions with customers.

Westpac last month pre-emptively announced that once Apple released TouchID to third parties, Westpac and subsidiary St George would use the technology as a log-in option on their respective mobile banking apps. McGuinness said ING Direct is currently investigating whether to do the same.

Westpac is also looking at the possibility of using the fingerprint sensor for internal third-party applications - to allow a handful of authorised staff to access restricted corporate apps, Zaid said.

Dalton expects ANZ will take advantage of TouchID to improve security, whether in place of a password for ANZ’s mobile banking application or as an extra means to authorise large payments.

“It would make it easier to log in, but you also might use it with a password and PIN to pay more than $5000, for example,” he suggested.

Apple also debuted a set of ‘Extensibility’ features with iOS 8, which will allow for better inter-app communications, among other things. Dalton said ANZ could use this to potentially integrate with third-party applications for better payment options.

A bank might, for example, offer payment choices at the point of purchase when a user is inside a shopping app, Dalton said. This new set of features could allow the shopping app to pull certain details from the user’s ANZ GoMoney app so the buyer could choose which account to pay from.

What did our three banking execs think of the phone itself? Read on for more...

The design

If you’ve ever held a Samsung phone or heard the word “phablet”, you’ll probably get a ping of recognition when picking up the larger iPhone 6 Plus.

Apple has paid homage to older iPhone models by ditching the square approach of the iPhone 5 for a curved, seamless aluminium design. The glass bars that ran along on the top and base of the iPhone 5 are replaced by a white or black lines, to allow for antenna clarity.

Apple has again tried to get each new model thinner than the last, and this iPhone is no exception - but you’ll quickly notice that it compromised on one design aspect to get the phone that bit thinner; the back camera lens sticks out significantly from the rest of the device.

While our banking mobility gurus had mixed feelings about the design, all agreed the decision to offer two choices of form factor was a good one and catered to users with different preferences and ways of working.

Westpac’s Zaid was not swayed to the larger display of the iPhone 6 Plus, and thought the design mimicked a Samsung device. It felt slightly less expensive than the iPhone 5, he said.

“The two form factors are nice, it gives options to different users, but the devices feel a bit less premium than previously.”

Zaid was, however, a fan of Apple’s decision to offer the user a choice of two app display sizes when setting up the phone. ING Direct’s McGuinness and ANZ’s Dalton agreed and both very quickly got used to using the larger-screened, curved device.

“The screen looks very crisp, and there’s less scrolling around with the extra line of real estate. It fits perfectly in a suit pocket,” Dalton noted.

“The curved display is nice, it feels good to hold in the hand,” McGuinness said. “The larger form factor is nice, maybe not so good as just a phone, but the larger real estate is great for working in apps.”

Your attitude to the phone’s price depends largely on how you plan to use the 5.5in monster: the iPhone 6 Plus starts at $999 for 16GB and goes all the way up to $1240 for the 128GB model. At that price, it competes in laptop territory - almost as much as you would pay for a 12 inch, 2.5Ghz MacBook Pro with a 500GB hard drive, which costs around $1349 from the Apple store.

Under the hood, the 6 Plus packs a 1.4GHz dual-core Apple A8 processor, which the company claims will consume 25 less of the 2915 mAH battery.

(In comparison, the similarly-sized 5.7in Galaxy Note 4 totes a 3220 mAh battery, while the smaller iPhone 6 carries a 1810 mAh battery, not significantly improved from the iPhone 5s’ 1500 mAh battery.)

The verdict

There’s a reason Apple reported sales of more than 10 million new iPhones in the weekend following the release of the devices on Friday - the company’s focus on design and user experience has resulted in yet another laudable device.

But while general consumers are once again lining up in droves to purchase another piece of Apple history, Australia’s banks still face an uncertain 12 to 18 months until Apple decides how and whether to launch its payments service down under.

In the meantime, the future of NFC-based stickers and cases hang in the balance.

Has Apple's lack of clarity on Apple Pay in Australia affected your NFC plans? Will the service make stickers and cases redundant? Tell us your thoughts below.

_(23).jpg&h=140&w=231&c=1&s=0)

_(33).jpg&h=140&w=231&c=1&s=0)

iTnews Benchmark Awards 2026

iTnews Benchmark Awards 2026

iTnews Executive Retreat - Security Leaders Edition

iTnews Executive Retreat - Security Leaders Edition

iTnews Cloud Covered Breakfast Summit

iTnews Cloud Covered Breakfast Summit

The 2026 iAwards

The 2026 iAwards

_(1).jpg&h=140&w=231&c=1&s=0)