Optus' failed attempt to stop Vodafone advertising 'Infinite' plans late last year produced an interesting side effect.

In a judgement that seems to defy everything we know about how consumers really behave, Federal Court Justice John Nicholas reasoned that: "Ordinary and reasonable consumers, who might be expected to take some care of their own interests, are likely to do more than simply rely upon ... television commercials in deciding whether or not to sign up to [Vodafone's] plan.

"These types of plans typically involve a contractual commitment of a year or more in duration and are invariably the subject of terms and conditions which relate to matters of detail of the kind that [Optus'] complaints focus upon."

If it were true, the "ordinary and reasonable consumer" would need to consider a plethora of price issues before signing a contract, including the high price of some mobile-originated calls and how expensive it will be for their friends and family with fixed line phones to call.

That's a task made more difficult by inconsistencies in the way mobile operators think and charge for services – take, for example, how calls to ‘freephone and local rate numbers’ (FLRN) are charged

No free or local rates for mobile users

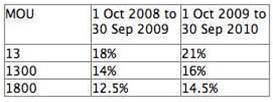

Consumer representation body ACCAN has launched a campaign aimed at 'overcharging' for calls to FLRNs, which include 13, 1300 and 1800 numbers, from mobile phones.

FLRNs use intelligent routing, so calls to those numbers from any fixed phone are charged at a local rate (13/1300) or free (1800).

But free or local pricing does not apply to mobiles; the charges were basically the same as the charges for ringing a standard, fixed-line phone.

There are three reasons behind ACCAN's campaign. Firstly, there has been an increasing number of consumers electing not to have fixed line phones; secondly, a lot of government services are only contactable through such numbers; and thirdly, apart from being more costly than a call to a geographic number they are sometimes not included in mobile "caps".

In a submission to the Department of Communications and the Australian Communications and Media Authority last November, industry groups acknowledged that mobile-originated traffic to FLRN services had grown.

The document was submitted by the Communications Alliance and the Australian Mobile Telecommunications Association, and obtained by iTnews under Freedom of Information.

Industry argued that ACCAN had erred in failing to ask the major enterprise and government customers of FLRNs whether they would pay more for their FLRN services to subsidise the call costs.

What industry did not do was advise the full details of the inter-carrier charging arrangements.

When a caller dials an FLRN from a fixed line, the FLRN operator (for example, Telstra or Optus) charges the number-holder and pays a PSTN (Public Switch Telephone Network) Originating Access fee to the fixed-line operator from which the call originates.

We can't tell from the mobile industry's submission whether mobile operators do or do not get paid an originating access charge by the FLRN operator (as happens to fixed line operators).

If they do, then the revenue they make from FLRN calls isn't just the (high) call charges but includes an inter-carrier revenue stream.

If they don't (as I suspect) then the growing proportion of mobile originated calls is reducing the costs for FLRN operators – but we have no evidence that the benefit is being passed on.

In short, mobile operators are overcharging for the service of calling 13, 1300 and 1800 numbers.

What industry did assert was that: "It is clear that some consumers are choosing to use a mobile phone for all their calling and giving up their fixed line service.

"However, this is generally done on the basis of weighing up the costs and benefits of such an arrangement and calls to FLRNs from mobiles are one cost of that choice that is taken into account and offset by the benefits (savings) the consumer sees with a mobile-only arrangement."

This contrasts with the view the mobile operators have about how calls from fixed-line services should be charged.

Termination charges go both ways

When consumers call a mobile number from a fixed-line service, the fixed-line network pays the mobile operator a Mobile Terminating Access Service fee.

The Australian Competition and Consumer Commission (ACCC) is currently consulting on this charge, which is a major cost for networks providing fixed to mobile calls (F2M).

Mobile operators admit that MTAS fees are above cost, but complain that they should not be regulated down, because there has been no "pass through" of the reductions in cheaper F2M prices.

Put simply, previous MTAS reductions have not led to equivalent price reductions for end-users, the ACCC notes in its discussion paper. Essentially Telstra – as the biggest fixed-line provider – gets to pocket the gains.

In their defence of the charges they make for FLRN calls, mobile operators say, 'You shouldn't look at an individual call price, you should look at the bundle of value'.

But in their MTAS arguments, operators say, 'You should look at the individual F2M call price, not the bundle'.

This is regulatory double speak. The stance taken by the operators depends on the conversation they are in.

Way forward

The mobile industry has suggested "further engagement with interested stakeholders, including ACCAN, community and commercial service providers, and Government agencies" as a path forward.

There are alternative ways around both issues.

Enterprise and Government customers could revert to making geographic numbers available for their call centres. It means citizens with mobile phones will get cheaper calls and agencies will make big savings on their FLRN costs.

Alternatively, mobile telcos could offer an "override code"-based F2M calling service that reflects the cost of MTAS, putting pressure on the bundled operators.

Both of these are fiddly – but apparently the industry is too sclerotic to resolve issues in a sensible way.

Meanwhile, of course, it is the mug punter who needs to work his way through incomprehensible pricing plans for both fixed and mobile services.

The industry can't take a consistent view on whether consumers do or don't consider bundles of prices. It looks like they agree with Justice Nicholas that "ordinary and reasonable consumers" can be expected to look into these "matters of detail".

Disclosure: David Havyatt was contracted by ACCAN to assist with their submission to the ACMA on FLRN.

_(23).jpg&h=140&w=231&c=1&s=0)

.png&h=140&w=231&c=1&s=0)

iTnews Executive Retreat - Security Leaders Edition

iTnews Executive Retreat - Security Leaders Edition

iTnews Benchmark Awards 2026

iTnews Benchmark Awards 2026

iTnews Cloud Covered Breakfast Summit

iTnews Cloud Covered Breakfast Summit

The 2026 iAwards

The 2026 iAwards

_(1).jpg&h=140&w=231&c=1&s=0)