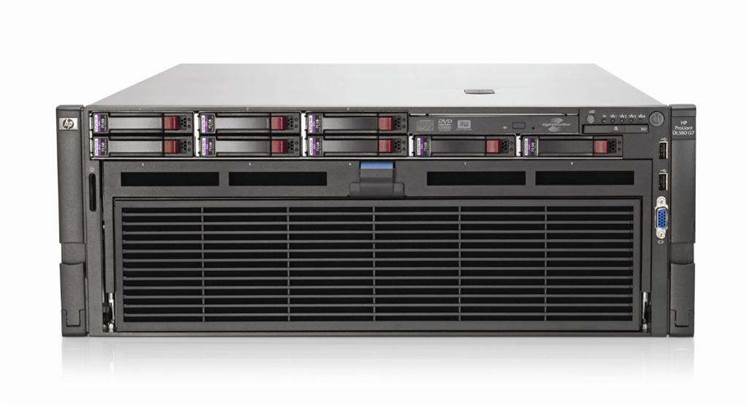

HP’s decision to no longer offer firmware updates for its server line unless a customer has signed a maintenance contract has been universally panned by customers.

It's indicative, they say, of a company that puts profit growth over the security and integrity of its products.

To be fair, HP's decision pitches it roughly in line with the stance of IBM, while giving a sniff of opportunity back to Dell and, to a lesser degree, Cisco Systems.

Companies will always seek a higher margin if “the market can bear it”, to quote a well-known Australian IT exec. Dell’s decision to exit the sharemarket to reinvent itself as a services company and IBM’s sale to Lenovo created a short-term window for opportunism.

But this latest move from HP might also point to a longer term problem that hardware vendors face in uncertain times for the traditional giants of the IT industry.

HP has - in the face of numerous challenges - managed to maintain its position as top dog in the server market. Gartner’s latest figures show that HP’s server revenue shot past IBM towards the end of 2013 with strong sales growth. But that makes for a hollow victory when accounting for the wave of activity washing over the industry at present.

Yes, it’s the cloud. Not so much the delivery model but the means by which it can generate more predictable revenues.

Server sales are a hard slog and market demand isn’t entirely predictable. Gartner reports that even though server shipments increased 1.9 percent year on year in Q3 2013, revenue from those sales fell 2.1 percent.

This would more than likely explain why Big Blue has looked to offload its x86 server unit to Lenovo. But even before that division was gone, more than half of IBM’s $99.7 billion annual revenue came from recurring annuity payments like outsourced services and software licences.

Recurring revenues

Nothing gives investors confidence in a company’s future like booked revenues. Even when they aren’t a sure thing (and rarely are), the mere fact large customers are signed to maintenance agreements or to a monthly cloud contract is a dependable sign of future growth.

.

Microsoft has thrived on this for some time. Redmond's ‘Software Assurance’ programs gives shareholders a long window of certainty, even as cloud competitors like Google aggressively go after its customers. Microsoft makes 47 percent of its revenues from commercial software licenses, and about eight percent from cloud subscriptions - the share of the latter rising exponentially.

Oracle and SAP are starting down the same path. In Oracle’s Q2 results announced late last year, the company recorded stronger revenue growth from software updates and support and maintenance agreements than sales of new software licenses (seven percent versus four percent). Oracle’s forward balance sheet suggests that over the 2014 fiscal year it expects that gap to widen significantly - a 24 percent boost in updates and maintenance versus a 15 percent decline in licensing revenue.

SAP is prepared to take a hit on revenues over the next few years to rebuild itself as a software-as-a-service company. SAP CEO Bill McDermott has said he wants 65 percent of SAP’s revenue to be recurring by 2017, compared to 50 percent today.

One metric that tells the story of how much the investment market is confident in a company’s future revenues is forward price-earning ratios. It is measured by dividing a company’s current share price by forecast earnings per share.

The average price to earnings ratio for tech stocks is usually around 25. Looking at prospects for the coming fiscal year, HP has a Forward PE of 7.6, IBM higher at 8.9, Oracle and Microsoft are around 12, SAP at 19.

SaaS players like Salesforce.com and NetSuite - while they struggle to turn a profit - have Forward PE’s over 100. The investment market is so convinced that while it costs money to lock a customer into a cloud platform, it’s more than offset by the far more predictable earnings once they are signed on. Little wonder IBM and Microsoft make a song and dance about the billions they are each spending on "the cloud" - they are dancing to the sharemarket's tune.

Hardware

Therein lies the challenge for HP, which remains predominantly a product company, despite its enterprise services and software assets.

Since 2010, the proportion of revenue earned on a recurring basis at HP has actually dropped.

Regardless of whether it remains a product/engineering focused company, HP needs to show investors that it too can lock in customers to annuity or monthly revenues.

Very little of that can surely come from locking customers into paying for Care Pack Services or other extended support agreements for server hardware. But a lot can be said for looking like you're turning the dial in the direction investors want.

Whether customers see it as the right direction is another matter entirely.

Clarification (12/02/2014): HP has released a statement saying it will offer security patches for its servers free of charge, and reiterated that its new charges only apply to its popular ProLiant line.

_(20).jpg&h=140&w=231&c=1&s=0)

_(33).jpg&h=140&w=231&c=1&s=0)

_(28).jpg&h=140&w=231&c=1&s=0)

iTnews Benchmark Awards 2026

iTnews Benchmark Awards 2026

iTnews Executive Retreat - Security Leaders Edition

iTnews Executive Retreat - Security Leaders Edition

iTnews Cloud Covered Breakfast Summit

iTnews Cloud Covered Breakfast Summit

The 2026 iAwards

The 2026 iAwards

_(1).jpg&h=140&w=231&c=1&s=0)