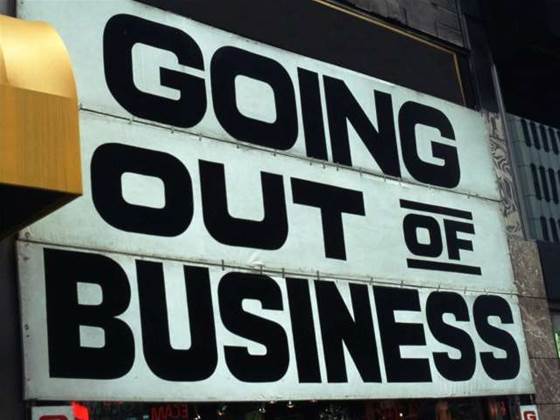

Nortel said that the decision has the unanimous authorisation of its board of directors, after consultation with advisors and extensive consideration of all other alternatives.

The company expects the process to allow it to deal with its cost and debt burden, restructure its operations and narrow its strategic focus.

Normal day-to-day operations will continue uninterrupted, it said.

Nortel has been losing money for several years, and saw a sharp decline in the value of its shares during 2008.

However, a statement issued in December claimed that no bankruptcy filing was imminent.

"These actions are imperative so that Nortel can build on its core strengths and become the highly focused and financially sound leader in the communications industry that its people, technology and customer relationships show it ought to be," said Nortel president and chief executive Mike Zafirovski in a statement.

Rob Bamforth, principal analyst for communications at Quocirca, expressed his surprise at the decision. "I know they had been struggling some years ago, but I thought they had turned the corner and sorted things out since then," he said.

Bamforth added that it is important to look beyond the immediate financial implications of the news.

"What's important for the long-term future are plans for the business. Nortel needs to decide what its core competencies are, and come out of Chapter 11 trading again," he said.

The analyst also warned that there could be further bad news in the industry.

"I would be expecting more mergers and takeovers in the telecoms business in the near future," he said.

_(28).jpg&h=140&w=231&c=1&s=0)

_(20).jpg&h=140&w=231&c=1&s=0)

_(26).jpg&w=100&c=1&s=0)

iTnews Executive Retreat - Security Leaders Edition

iTnews Executive Retreat - Security Leaders Edition

_(1).jpg&h=140&w=231&c=1&s=0)